Quantmod

Quantmod stands for ``quantitative financial modelling framework’’. It has three main functions:

- download data,

- charting, and

- technical indicator.

Then we can conduct simple test on trading strategies. We will learn how to test more complicated strategies.

Before we start, let us use the following code install and load quantmod.

library(quantmod)install.packages("quantmod")

library(quantmod)Learning Objectives:

Use quantmod package to download stock prices

create chart of stock prices and add technical indicators

construct simple trading indicator and apply it into trading

evaluate the performance of a trading rule based on return data

Downloading data

Use getSymbols to get data from yahoo or Google (default is yahoo)

getSymbols("AAPL")Let see what is inside the data.

head(AAPL)## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume

## 2003-01-02 0.5083427 0.5281666 0.5079888 0.5239188 45357200

## 2003-01-03 0.5239188 0.5285210 0.5164849 0.5274589 36863400

## 2003-01-06 0.5320605 0.5444505 0.5267507 0.5274589 97633200

## 2003-01-07 0.5235650 0.5309990 0.5122366 0.5256886 85586200

## 2003-01-08 0.5161310 0.5207326 0.5111750 0.5150689 57411200

## 2003-01-09 0.5175469 0.5281666 0.5132987 0.5196706 53813200

## AAPL.Adjusted

## 2003-01-02 0.926088

## 2003-01-03 0.932345

## 2003-01-06 0.932345

## 2003-01-07 0.929217

## 2003-01-08 0.910444

## 2003-01-09 0.918579To extract columns, we use Op, Hi, Lo, Cl, Vo and Ad

Open <- Op(AAPL) #Open Price

High <- Hi(AAPL) # High price

Low <- Lo(AAPL) # Low price

Close<- Cl(AAPL) #Close Price

Volume <- Vo(AAPL) #Volume

AdjClose <- Ad(AAPL) # Adjusted closeIf you wish to only import at a certain date e.g.,. 2000-01-01 to 2015-09-25, we can restrict the set the data to download.

getSymbols("AAPL", from='2000-01-01',to='2015-09-25')## [1] "AAPL"Alternatively, we can load the whole series and restrict using xts function last()

getSymbols("AAPL")## [1] "AAPL"AAPL <- last(AAPL,'1 year')

head(AAPL)## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume

## 2019-01-02 154.89 158.85 154.23 157.92 37039700

## 2019-01-03 143.98 145.72 142.00 142.19 91312200

## 2019-01-04 144.53 148.55 143.80 148.26 58607100

## 2019-01-07 148.70 148.83 145.90 147.93 54777800

## 2019-01-08 149.56 151.82 148.52 150.75 41025300

## 2019-01-09 151.29 154.53 149.63 153.31 45099100

## AAPL.Adjusted

## 2019-01-02 156.6424

## 2019-01-03 141.0396

## 2019-01-04 147.0605

## 2019-01-07 146.7332

## 2019-01-08 149.5304

## 2019-01-09 152.0697Alternatively, we can take the first 3 years by using first():

getSymbols("AAPL")## [1] "AAPL"AAPL <- first(AAPL,'3 years')

head(AAPL)## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume

## 2007-01-03 12.32714 12.36857 11.70000 11.97143 309579900

## 2007-01-04 12.00714 12.27857 11.97429 12.23714 211815100

## 2007-01-05 12.25286 12.31428 12.05714 12.15000 208685400

## 2007-01-08 12.28000 12.36143 12.18286 12.21000 199276700

## 2007-01-09 12.35000 13.28286 12.16429 13.22429 837324600

## 2007-01-10 13.53571 13.97143 13.35000 13.85714 738220000

## AAPL.Adjusted

## 2007-01-03 10.48732

## 2007-01-04 10.72009

## 2007-01-05 10.64375

## 2007-01-08 10.69631

## 2007-01-09 11.58486

## 2007-01-10 12.13926We can also import three stocks at the same time by using a vector.

getSymbols(c("AAPL","GOOG"))## [1] "AAPL" "GOOG"Alternatively, we can assign a vector of stocks and import based on the vector.

stocklist <- c("AAPL","GOOG")

getSymbols(stocklist)The package can also import non-US stocks.

getSymbols("0941.hk")

#If error, try instead the following:

#getSymbols("0941.HK",src="yahoo", auto.assign=FALSE)head(`0941.HK`)## 0941.HK.Open 0941.HK.High 0941.HK.Low 0941.HK.Close

## 2007-01-02 67.25 70.00 67.10 69.6

## 2007-01-03 69.90 71.80 69.50 70.7

## 2007-01-04 70.60 70.95 67.30 68.2

## 2007-01-05 67.50 69.50 66.30 69.5

## 2007-01-08 67.50 68.40 67.45 67.7

## 2007-01-09 68.00 68.60 65.55 66.3

## 0941.HK.Volume 0941.HK.Adjusted

## 2007-01-02 35293388 45.29848

## 2007-01-03 41163203 46.01438

## 2007-01-04 37286533 44.38728

## 2007-01-05 24502496 45.23338

## 2007-01-08 15584163 44.06187

## 2007-01-09 17861491 43.15070Besides prices, very often we are interested in the trading volume. Moreover, we would like to find volume over time: weekly, monthly, quarterly and yearly. We can use apply and sum to calculate the rolling sum of volume to each distinct period.

WeekVoYa<- apply.weekly(Vo(AAPL),sum)

# sum from Monday to Friday

MonthVoYa <- apply.monthly(Vo(AAPL),sum)

# sum to month

QuarterVoYa <- apply.quarterly(Vo(AAPL),sum)

# sum to quarter

YearVoYa <- apply.yearly(Vo(AAPL),sum)

# sum to yearIn some case, we are interested in average than the sum. Then we can use apply and mean.

WeekAveVoClYa<- apply.weekly(Vo(AAPL),mean)

# weekly average volumeCharting

Quantmod draw nice charts of following common types:

- line

- bars

- candlesticks

We can use chartSeries() and specify the types directly.

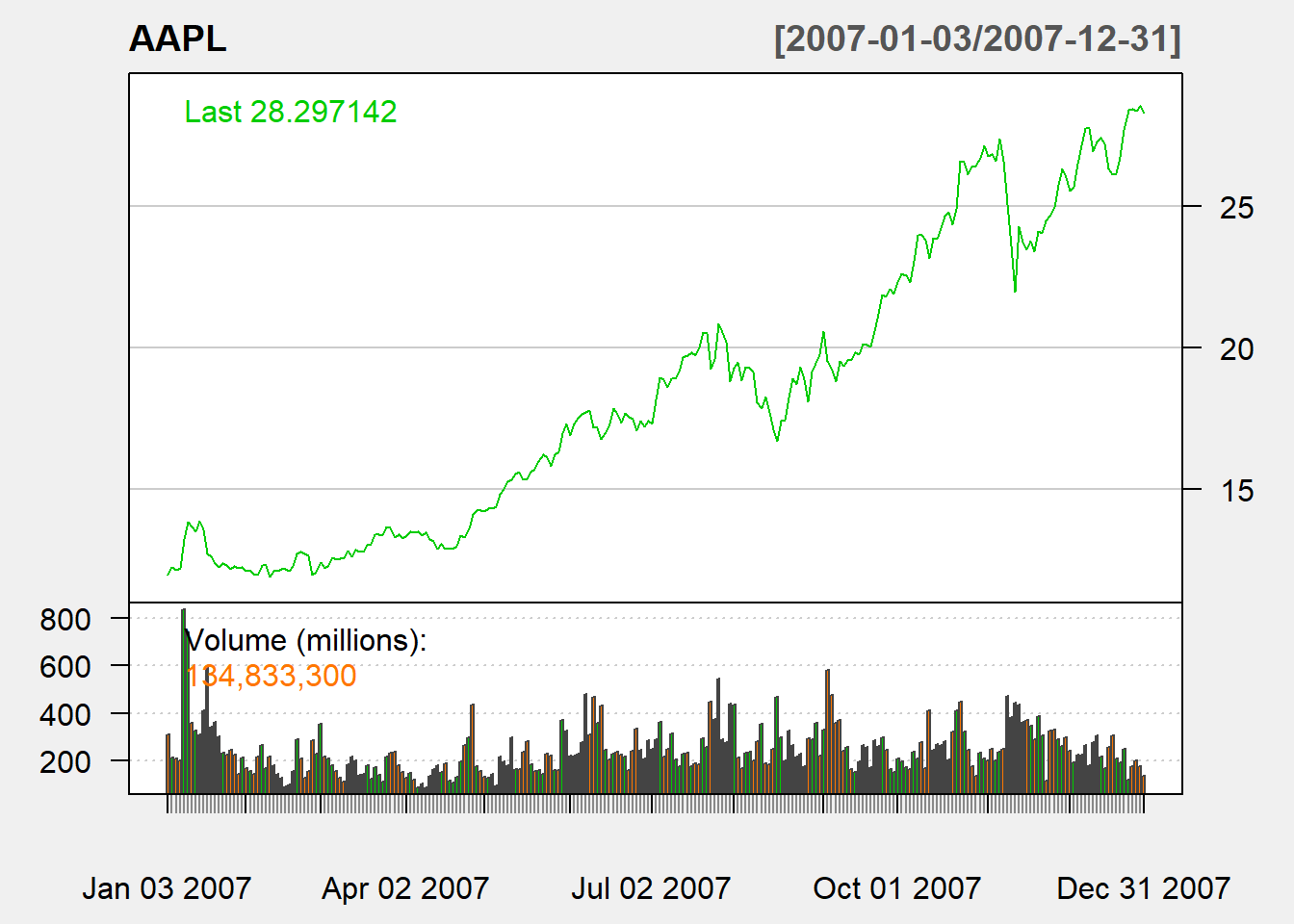

The line chart displays stock price of AAPL in 2007 by using the subset option. The option theme is set to be chartTheme(‘white’) as the default option chartTheme(‘black’) is not printer-friendly.

chartSeries(AAPL,

type="line",

subset='2007',

theme=chartTheme('white'))

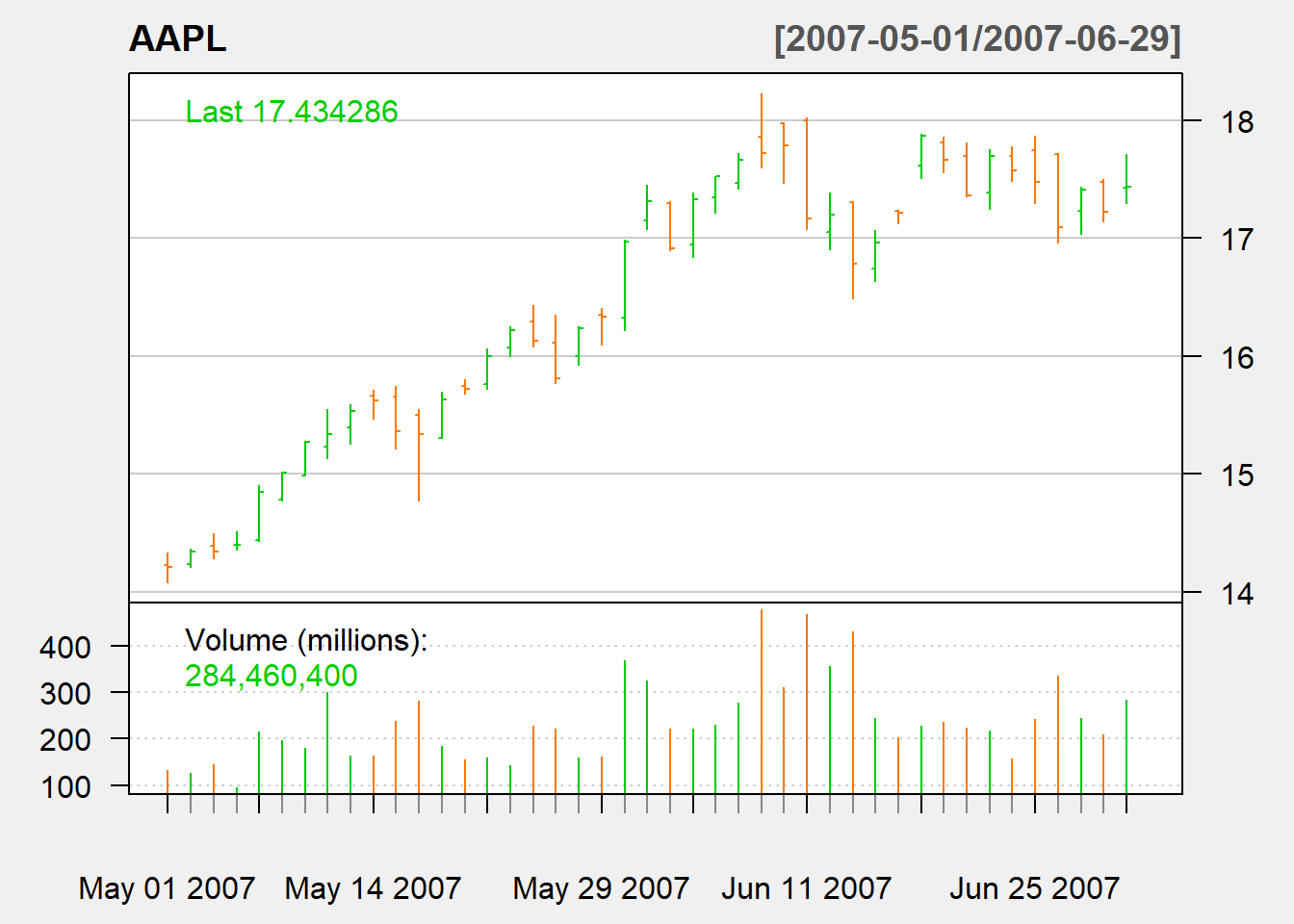

The bar chart displays stock price of AAPL in May to June 2007 by using the subset option.

chartSeries(AAPL,

type="bar",

subset='2007-05::2007-06',

theme=chartTheme('white'))

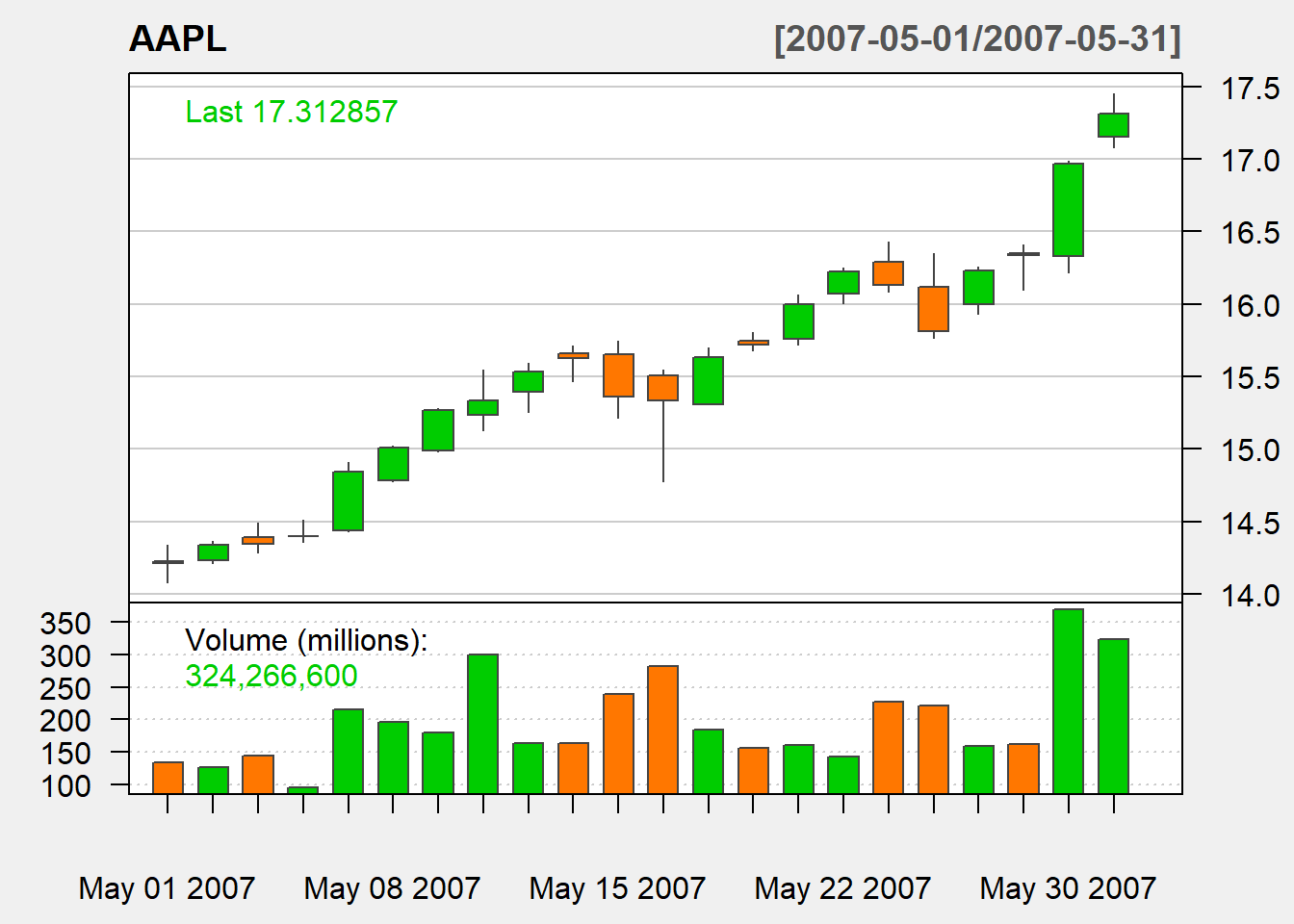

The following candle stick chart displays stock price of AAPL in May only.

chartSeries(AAPL,

type="candlesticks",

subset='2007-05',

theme=chartTheme('white'))

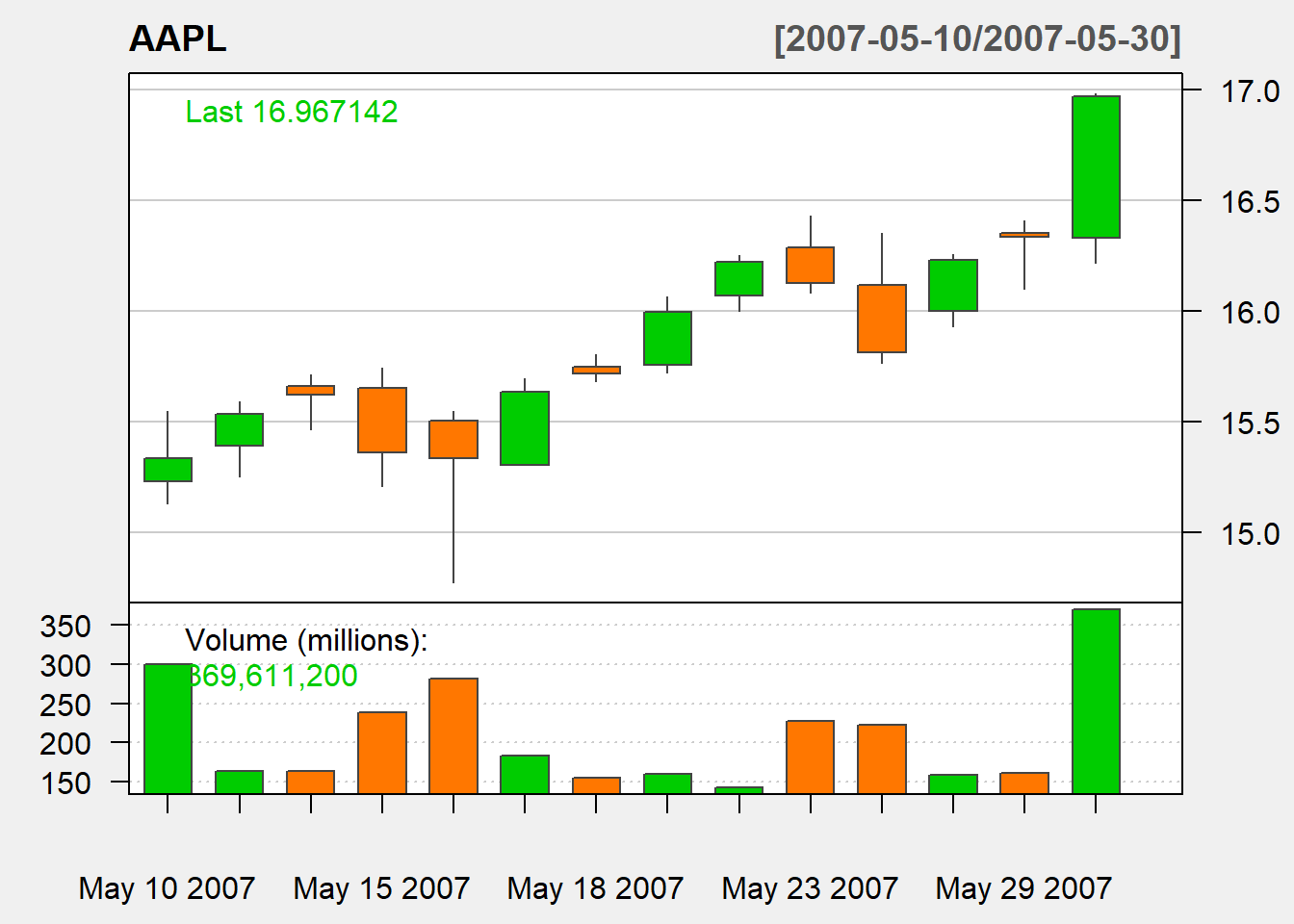

Finally The following candle stick chart displays stock price of AAPL a few days in May.

chartSeries(AAPL,

type="auto",

subset='2007-05-10::2007-05-30',

theme=chartTheme('white'))

Technical Indicators

Technical trading rule (TTR) package is loaded when we load quantmod package.

If you want to use it separately, then just load the package as usual:

install.packages("TTR")

library(TTR)Simple Moving Average

sma <-SMA(Cl(AAPL),n=20)

tail(sma,n=5)## SMA

## 2019-07-25 203.6590

## 2019-07-26 204.0590

## 2019-07-29 204.6470

## 2019-07-30 205.0085

## 2019-07-31 205.5240Exponential moving average

ema <-EMA(Cl(AAPL),n=20)

tail(ema,n=5)## EMA

## 2019-07-25 203.4299

## 2019-07-26 203.8404

## 2019-07-29 204.3965

## 2019-07-30 204.8140

## 2019-07-31 205.5974Bollinger band

bb <-BBands(Cl(AAPL),s.d=2)

tail(bb,n=5)## dn mavg up pctB

## 2019-07-25 197.9699 203.6590 209.3481 0.7953875

## 2019-07-26 198.4034 204.0590 209.7146 0.8254313

## 2019-07-29 199.2263 204.6470 210.0677 0.9642364

## 2019-07-30 199.4986 205.0085 210.5185 0.8422443

## 2019-07-31 199.1085 205.5240 211.9395 1.0857640Momentum

We calculate 2-day momentum based on closing price of AAPL.

M <- momentum(Cl(AAPL), n=2)

head (M,n=5)## AAPL.Close

## 2007-01-03 NA

## 2007-01-04 NA

## 2007-01-05 0.178571

## 2007-01-08 -0.027143

## 2007-01-09 1.074286ROC

ROC <- ROC(Cl(AAPL),n=2)

# 2-day ROC

head(ROC,n=5)## AAPL.Close

## 2007-01-03 NA

## 2007-01-04 NA

## 2007-01-05 0.014806276

## 2007-01-08 -0.002220547

## 2007-01-09 0.084725818MACD

macd <- MACD(Cl(AAPL), nFast=12, nSlow=26,

nSig=9, maType=SMA)

tail(macd,n=5)## macd signal

## 2019-07-25 1.323582 1.453901

## 2019-07-26 1.319240 1.410081

## 2019-07-29 1.448455 1.389803

## 2019-07-30 1.481109 1.371400

## 2019-07-31 1.524268 1.362328RSI

rsi = RSI(Cl(AAPL), n=14)

tail(rsi,n=5)## rsi

## 2019-07-25 60.00658

## 2019-07-26 61.11691

## 2019-07-29 64.01577

## 2019-07-30 61.71700

## 2019-07-31 67.64034Charting with Indicators

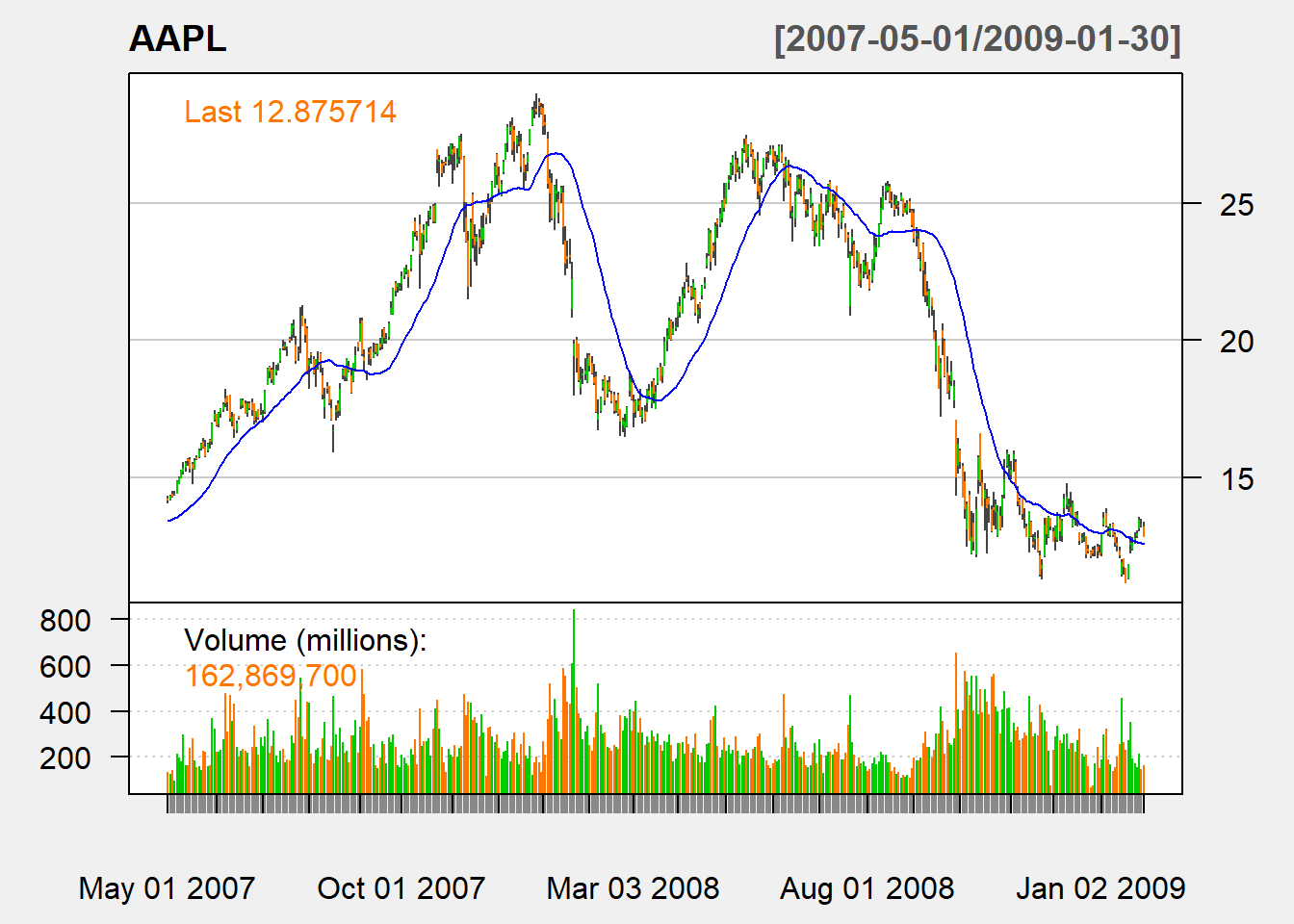

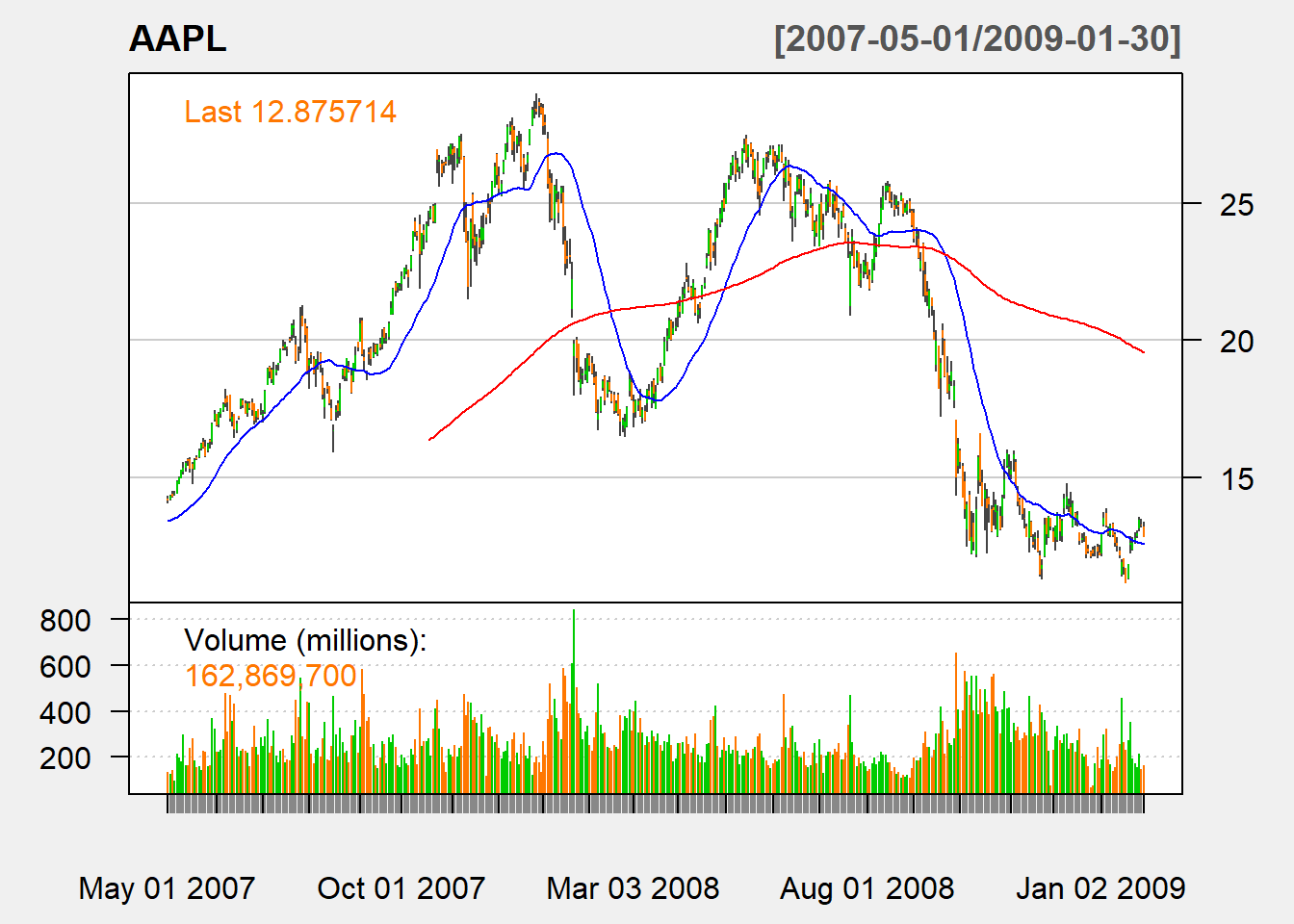

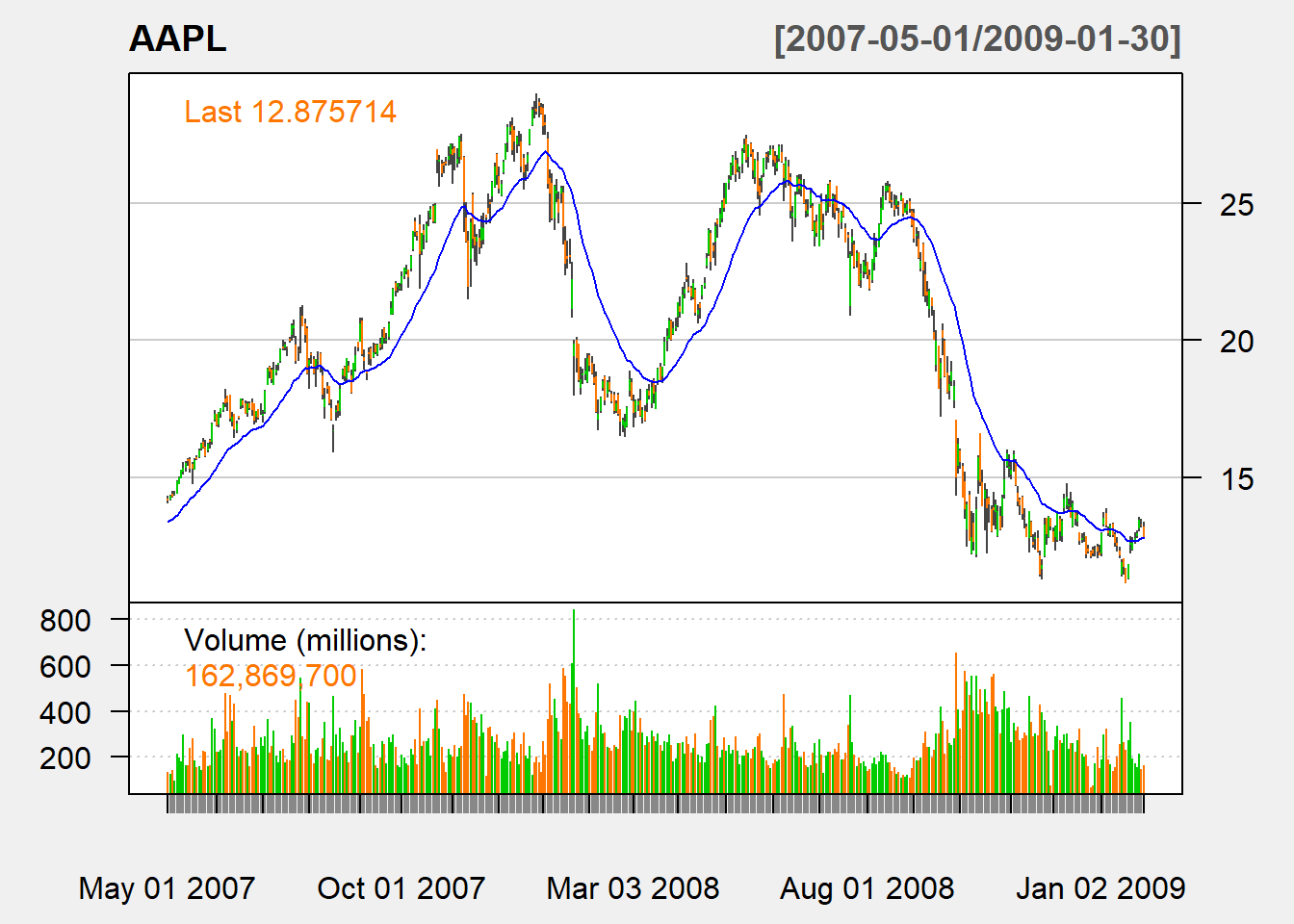

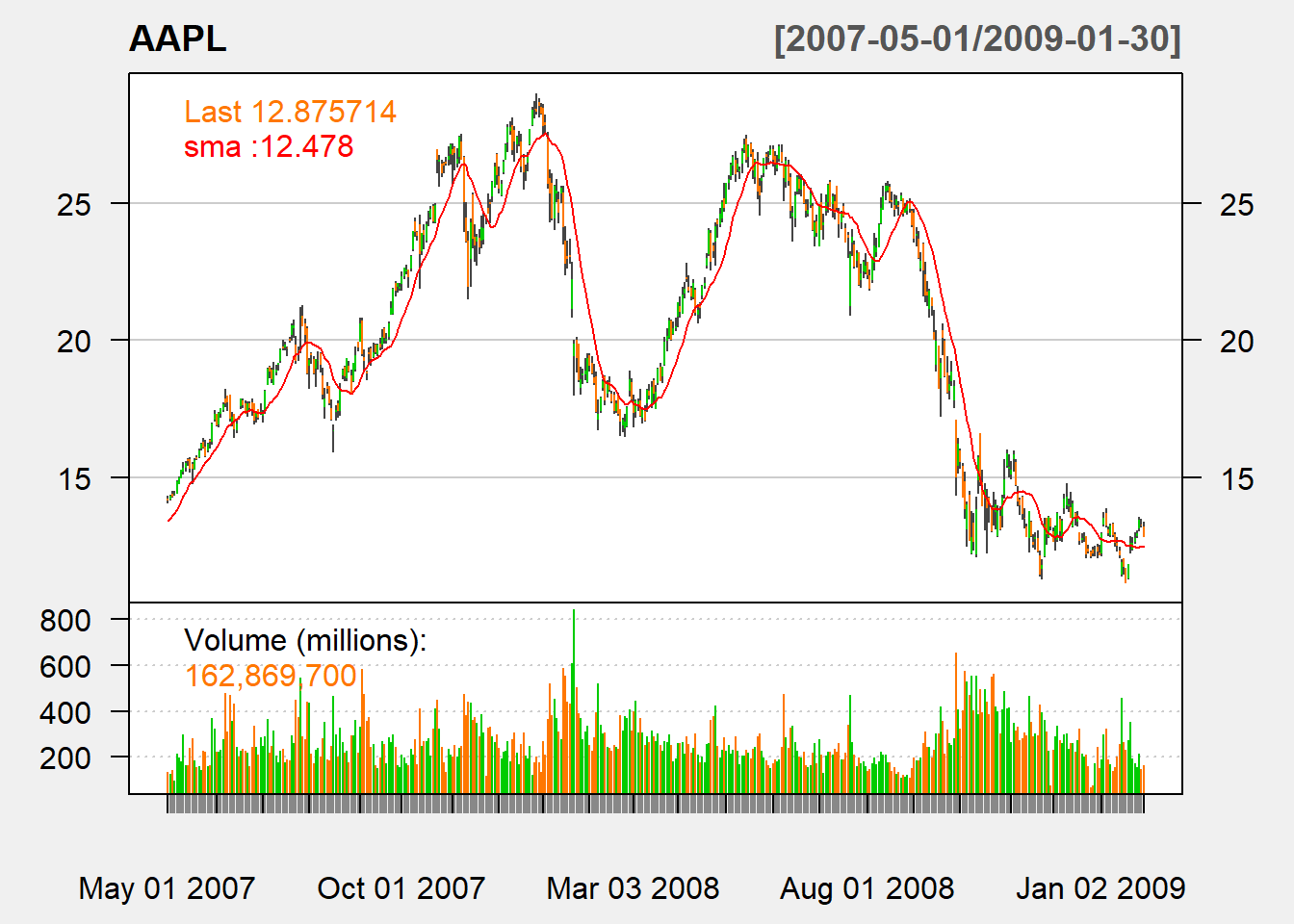

Charting SMA

We use the function addSMA() to put

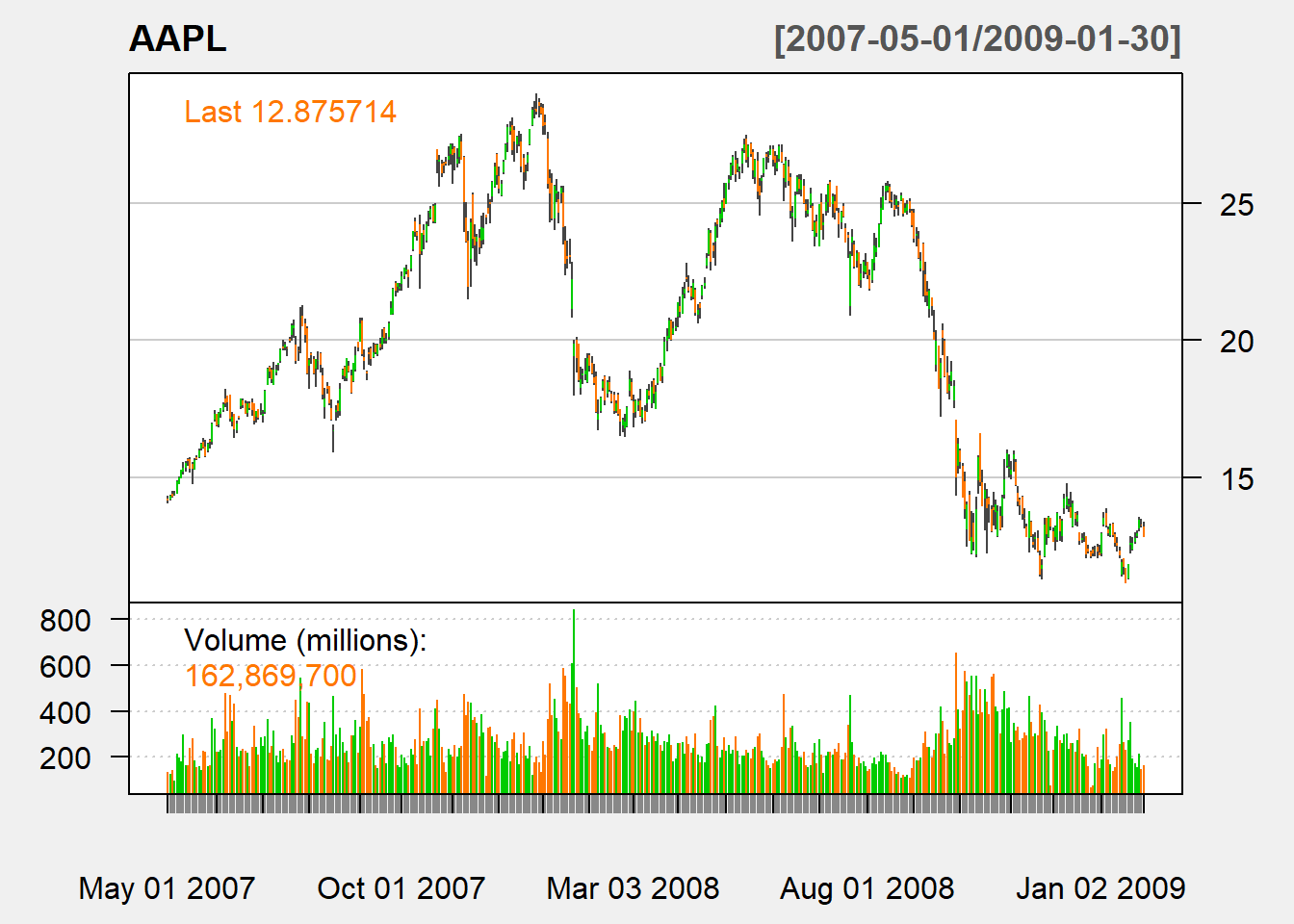

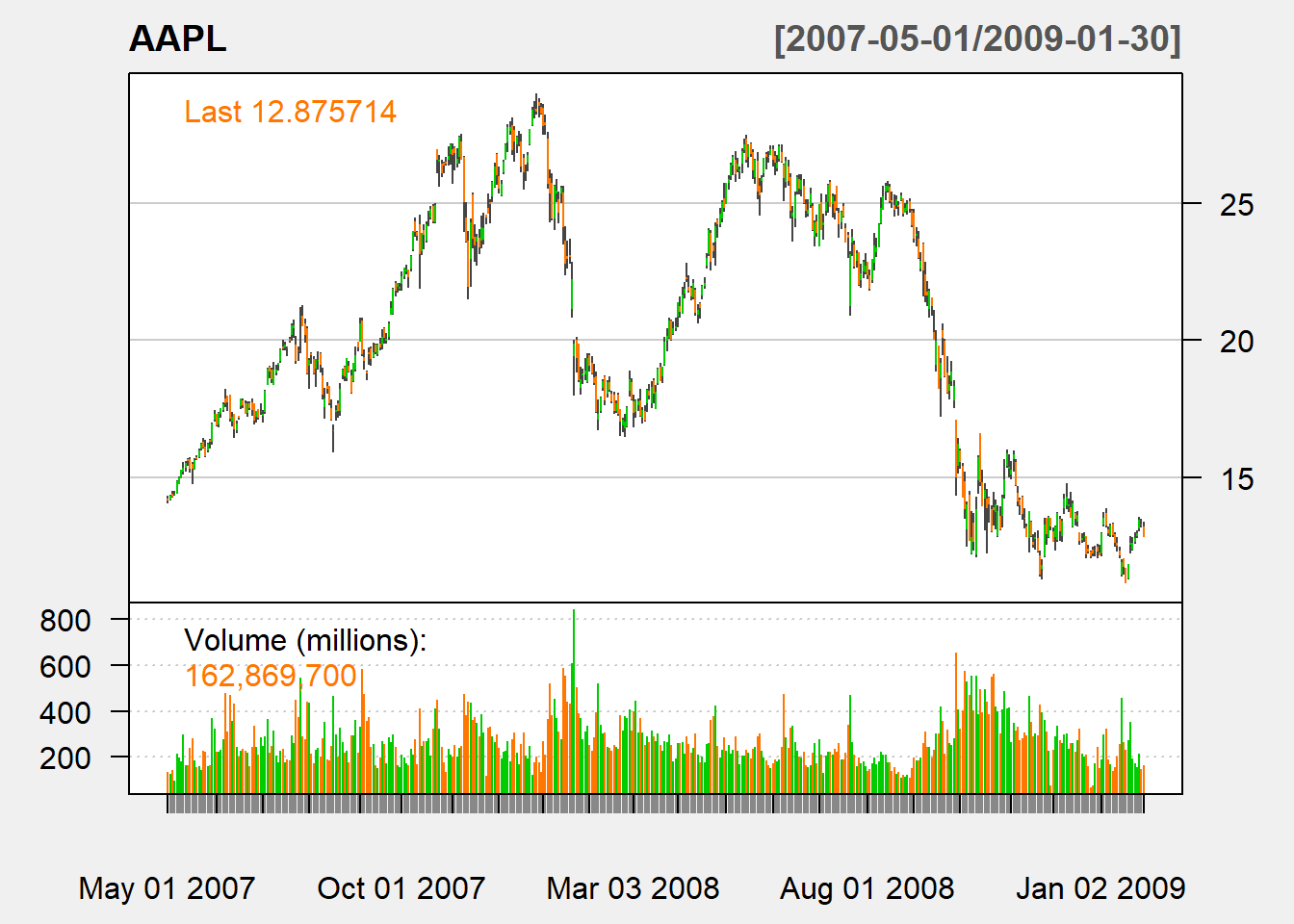

chartSeries(AAPL,

subset='2007-05::2009-01',

theme=chartTheme('white'))

addSMA(n=30,on=1,col = "blue")

addSMA(n=200,on=1,col = "red")

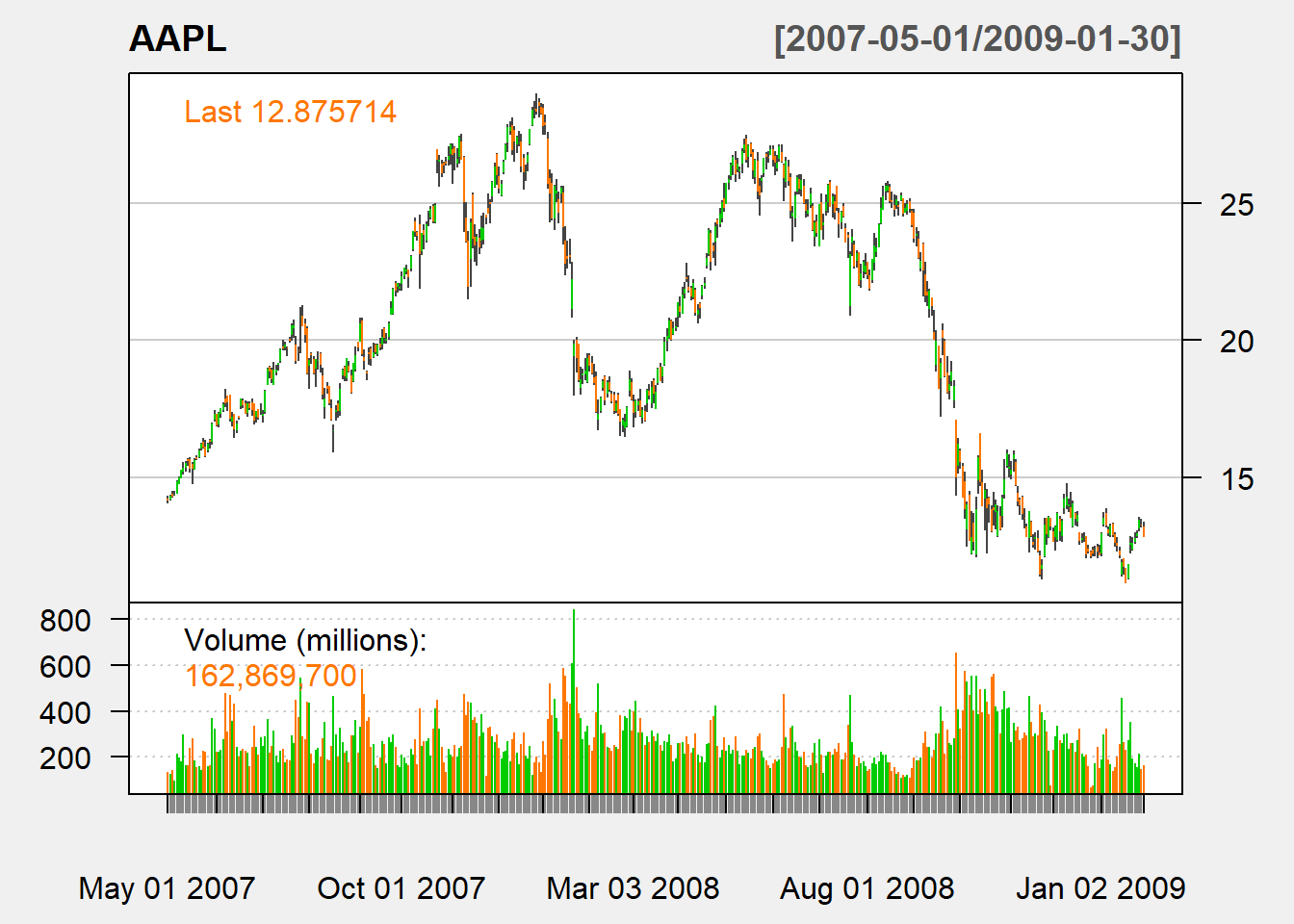

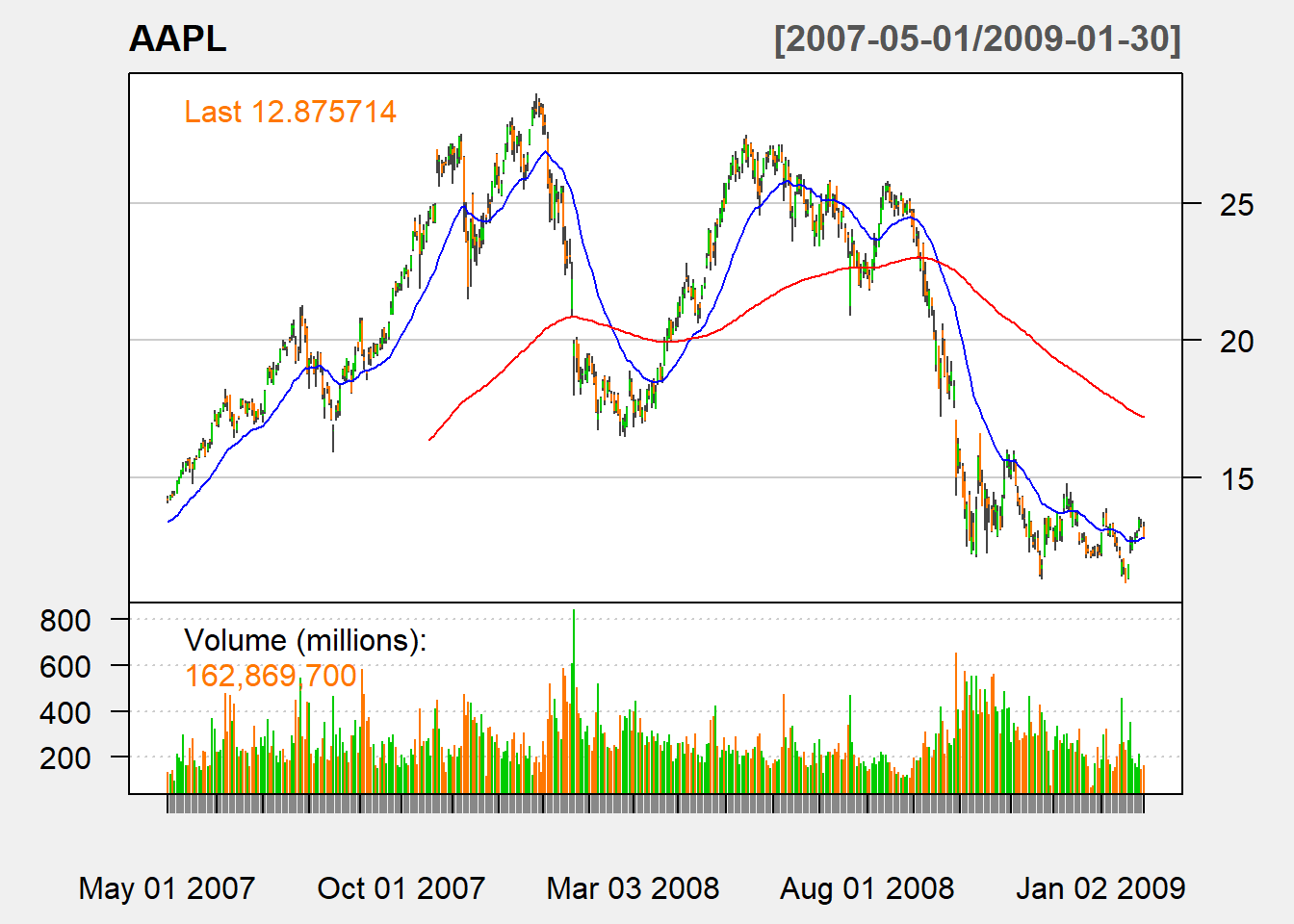

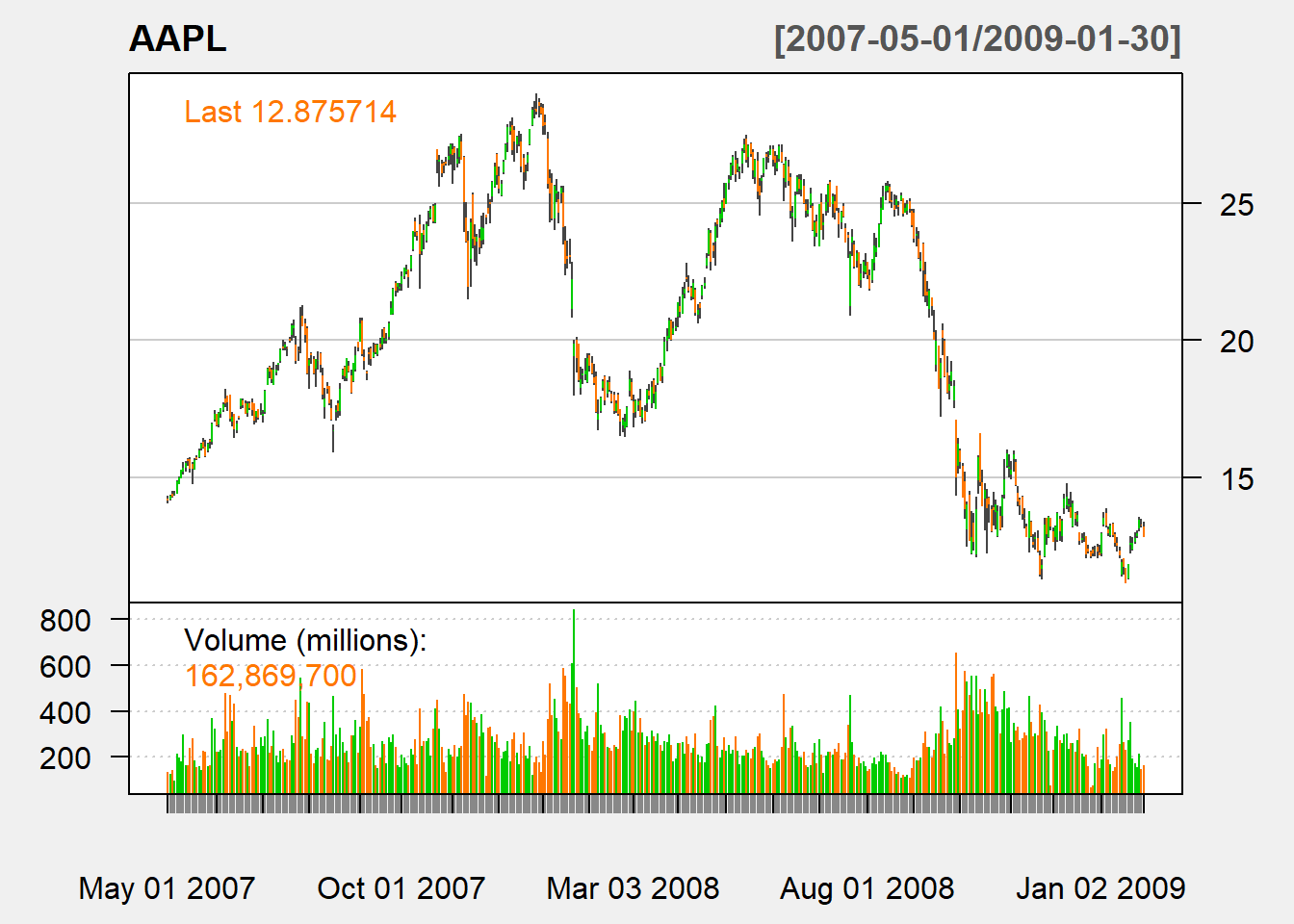

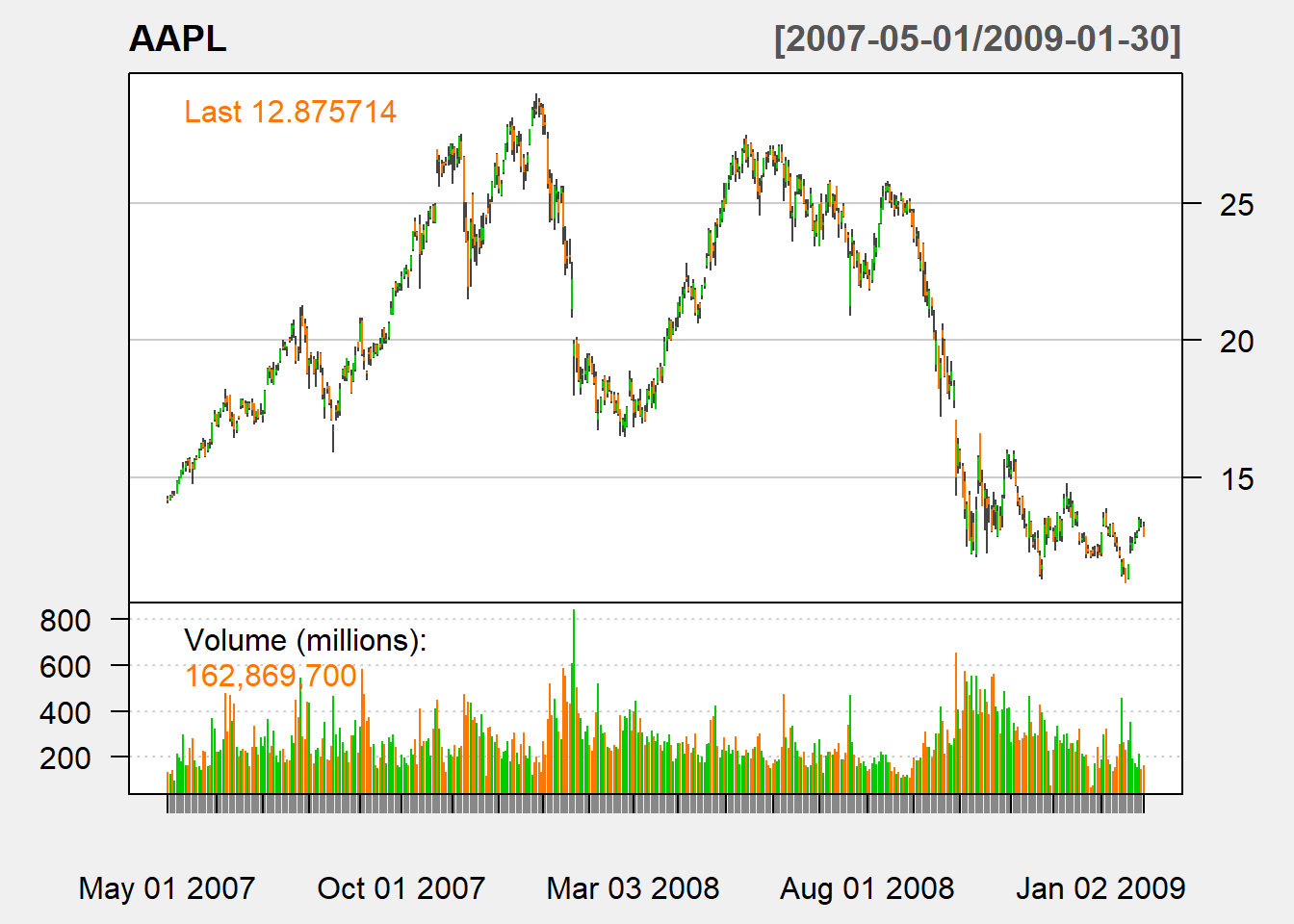

Charting EMA

chartSeries(AAPL,

subset='2007-05::2009-01',

theme=chartTheme('white'))

addEMA(n=30,on=1,col = "blue")

addEMA(n=200,on=1,col = "red")

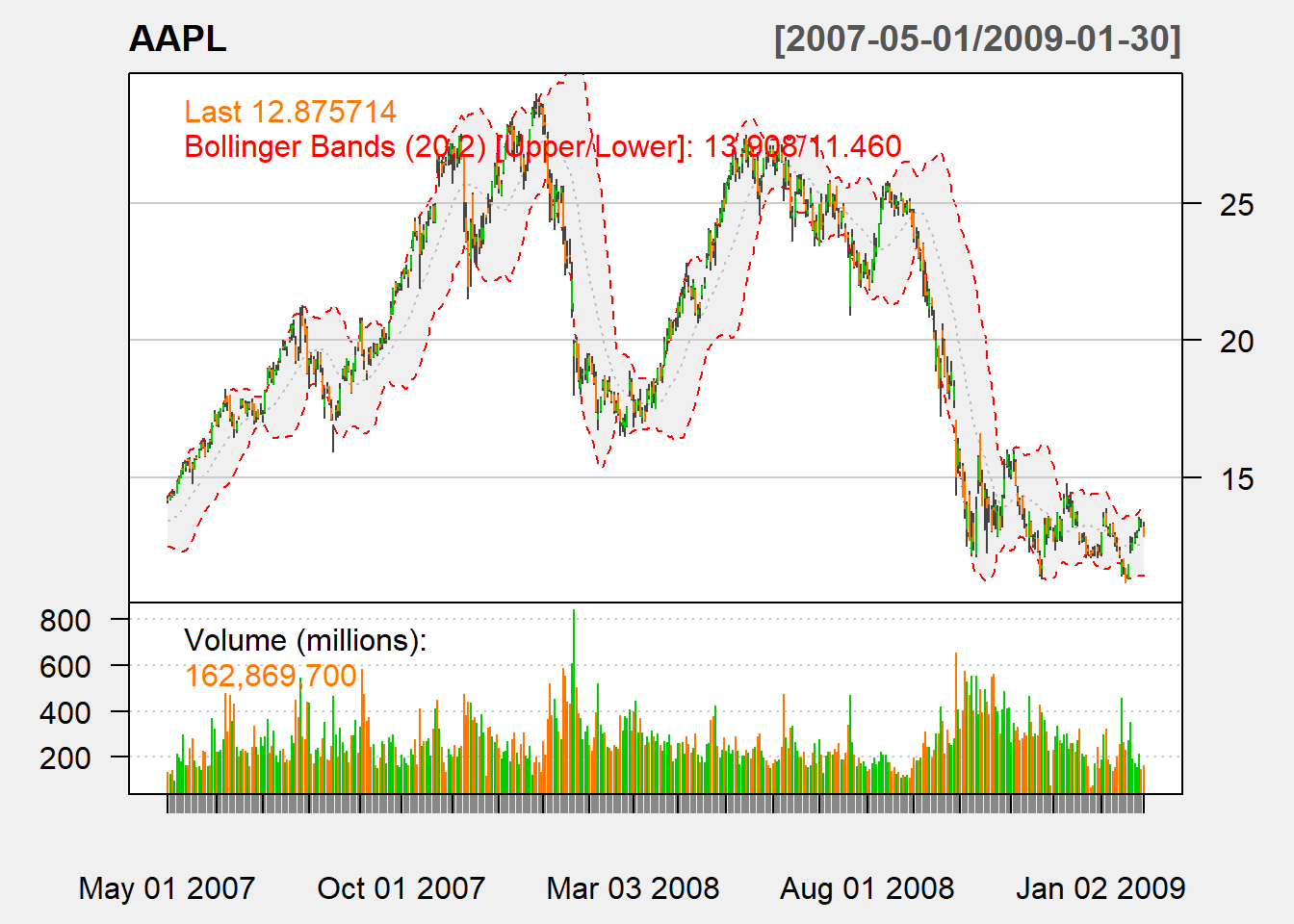

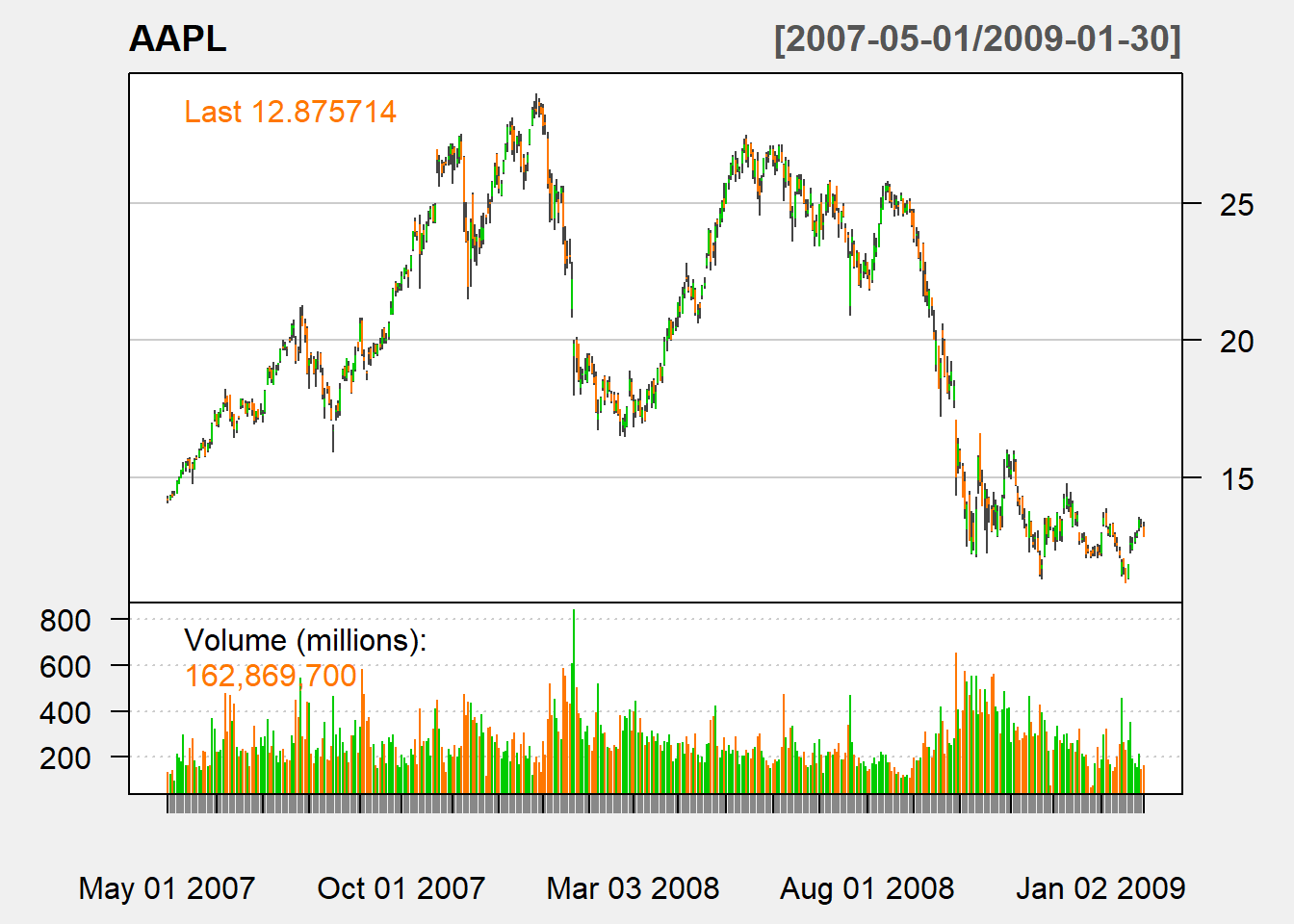

Charting Bollinger band

chartSeries(AAPL,

subset='2007-05::2009-01',

theme=chartTheme('white'))

addBBands(n=20,sd=2)

Charting Momentum

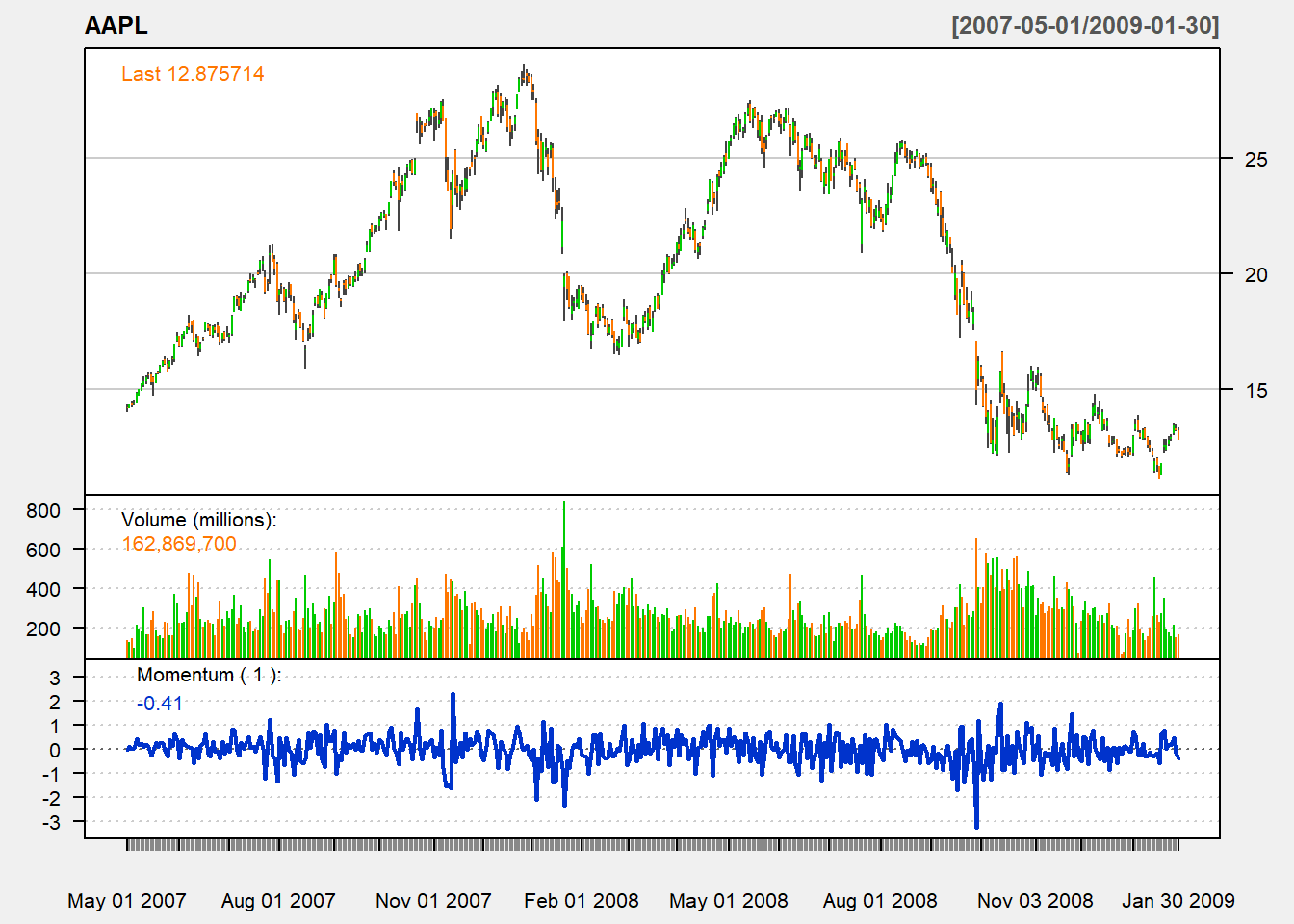

chartSeries(AAPL,

subset='2007-05::2009-01',

theme=chartTheme('white'))

addMomentum(n=1)

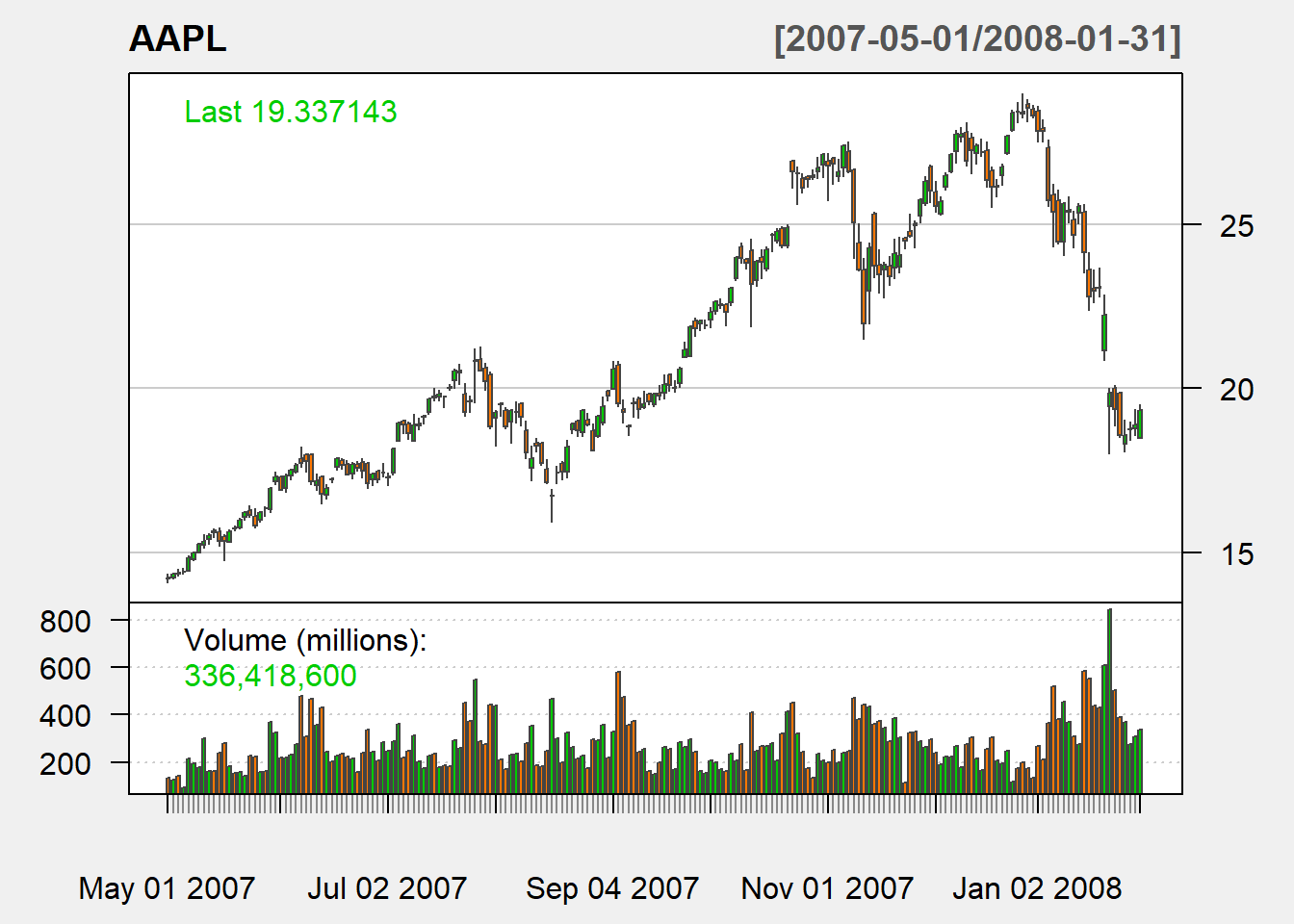

Charting ROC

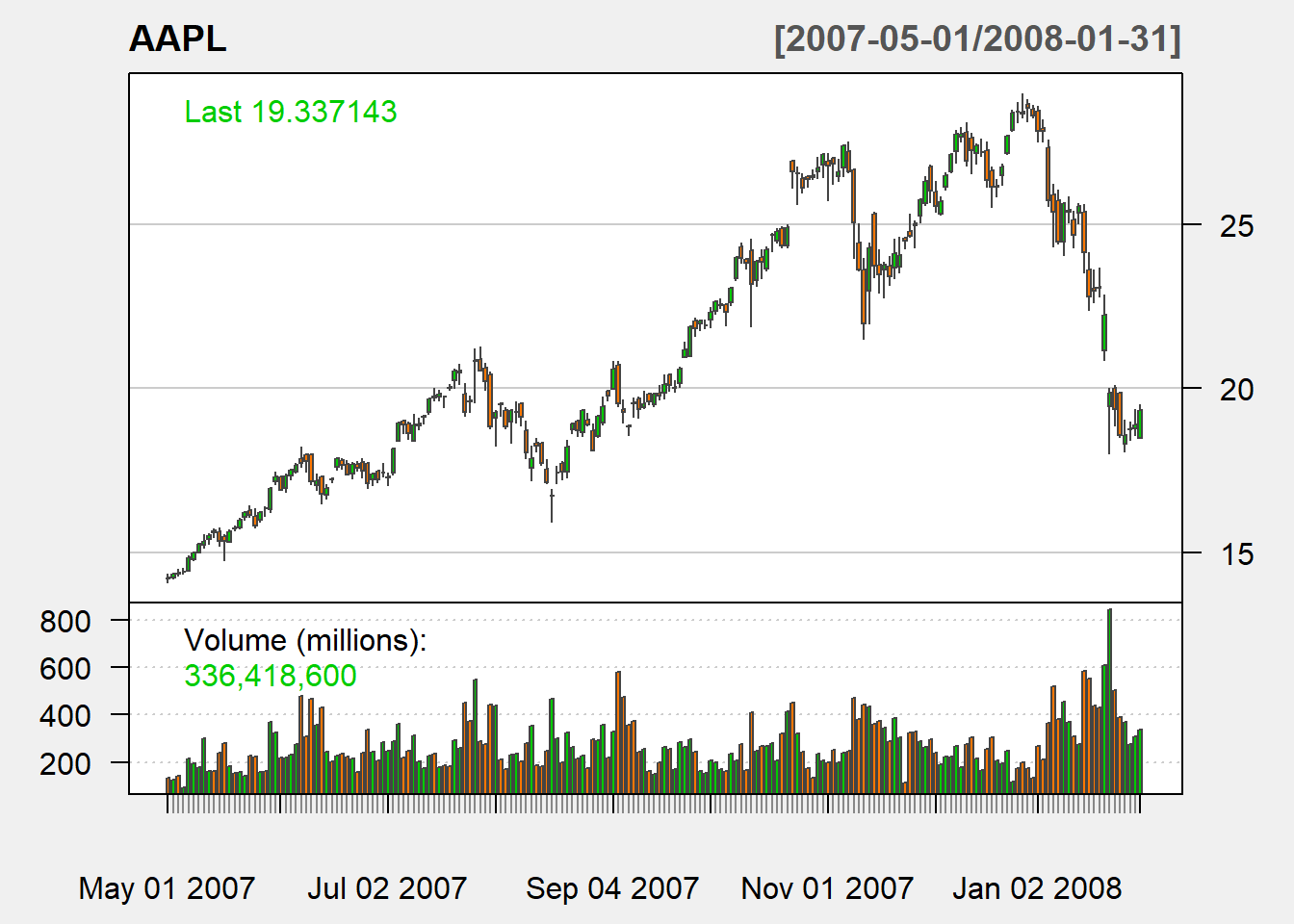

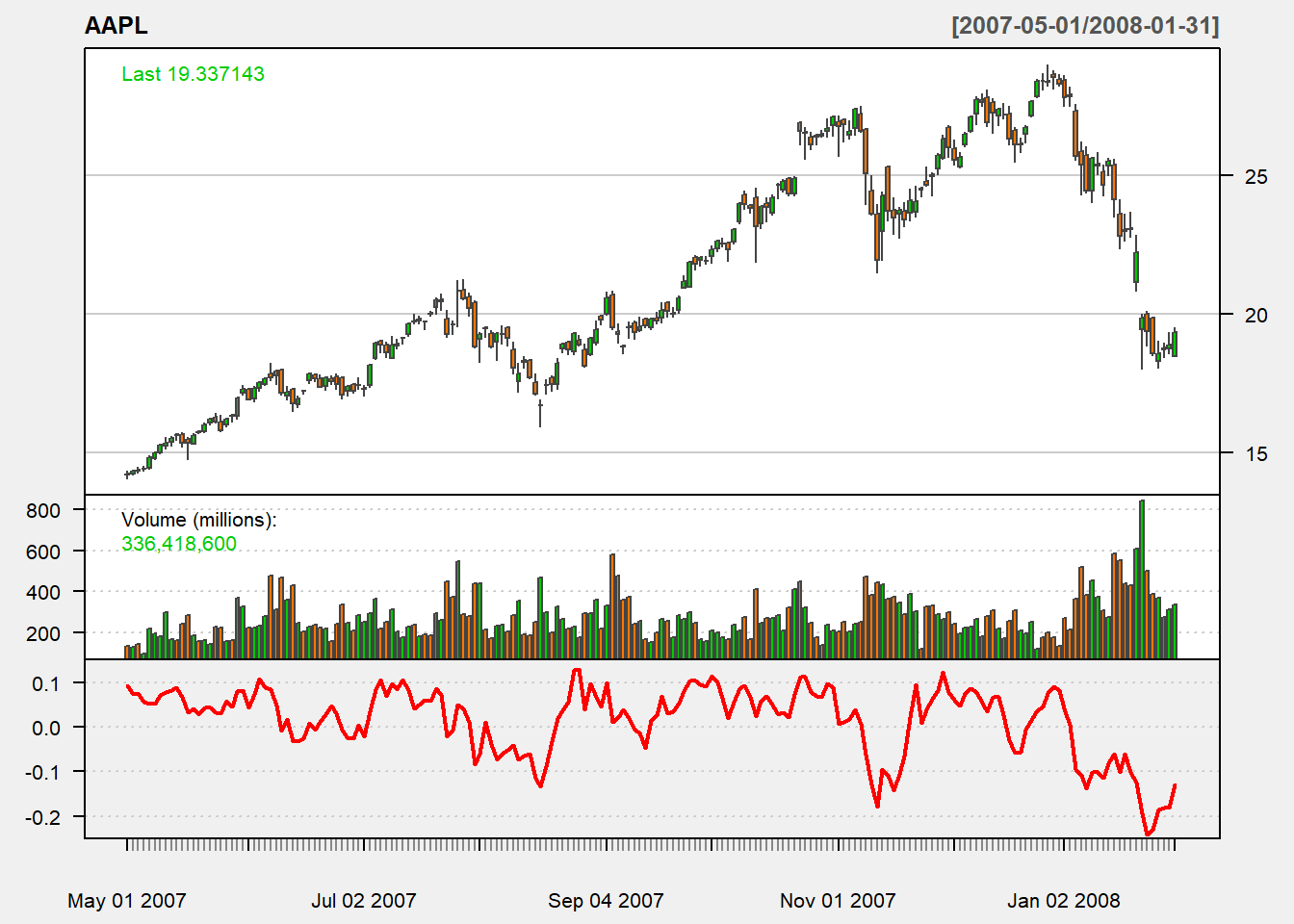

chartSeries(AAPL,

subset='2007-05::2008-01',

theme=chartTheme('white'))

addROC(n=7)

Charting MACD

chartSeries(AAPL,

subset='2007-05::2008-01',

theme=chartTheme('white'))

addMACD(fast=12,slow=26,signal=9,type="EMA")

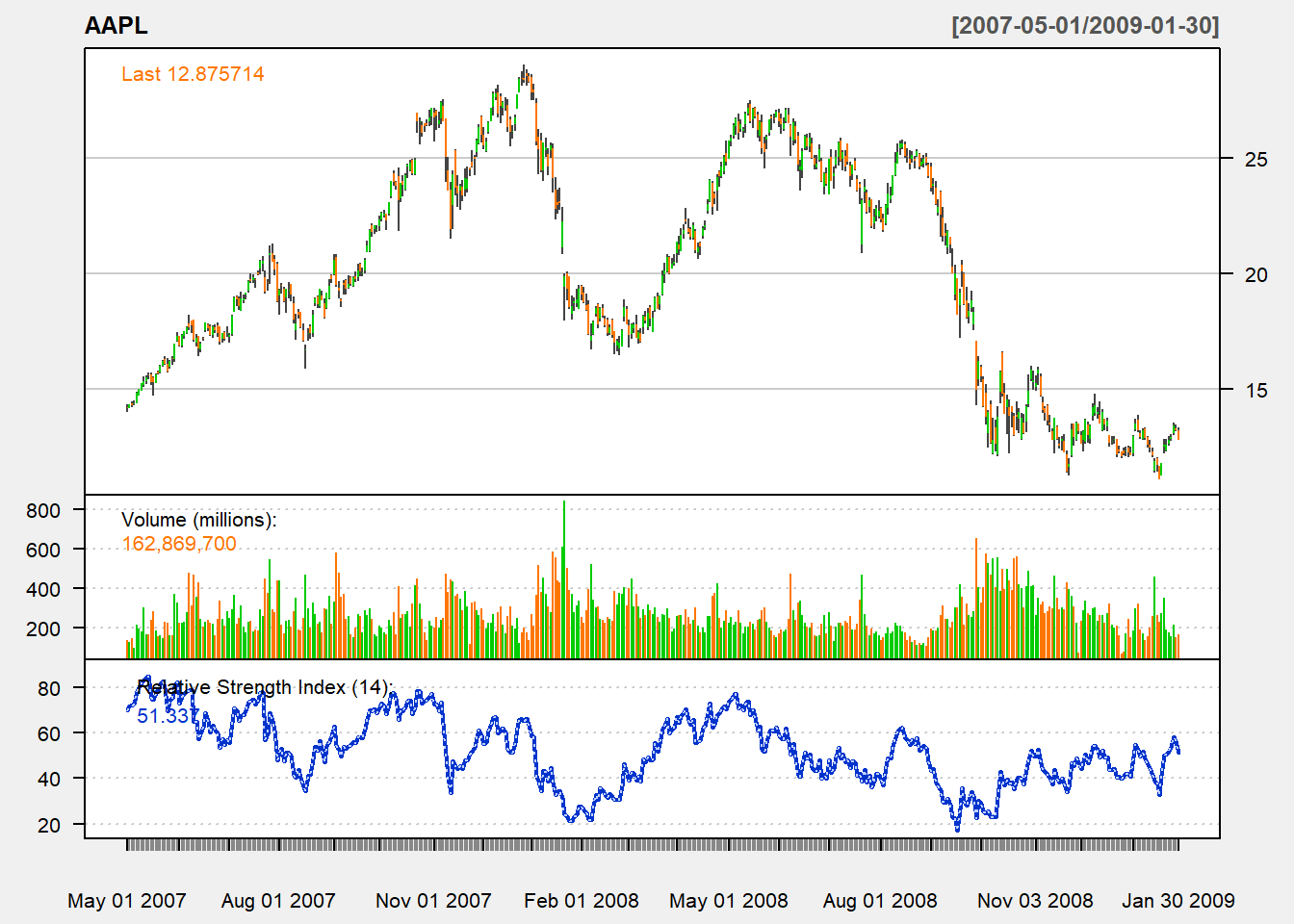

Charting RSI

chartSeries(AAPL,

subset='2007-05::2009-01',

theme=chartTheme('white'))

addRSI(n=14,maType="EMA")

Charting Custom TA

sma <- SMA(Cl(AAPL),n=14)

chartSeries(AAPL,

subset='2007-05::2009-01',

theme=chartTheme('white'))

addTA(sma, on=1, col="red")

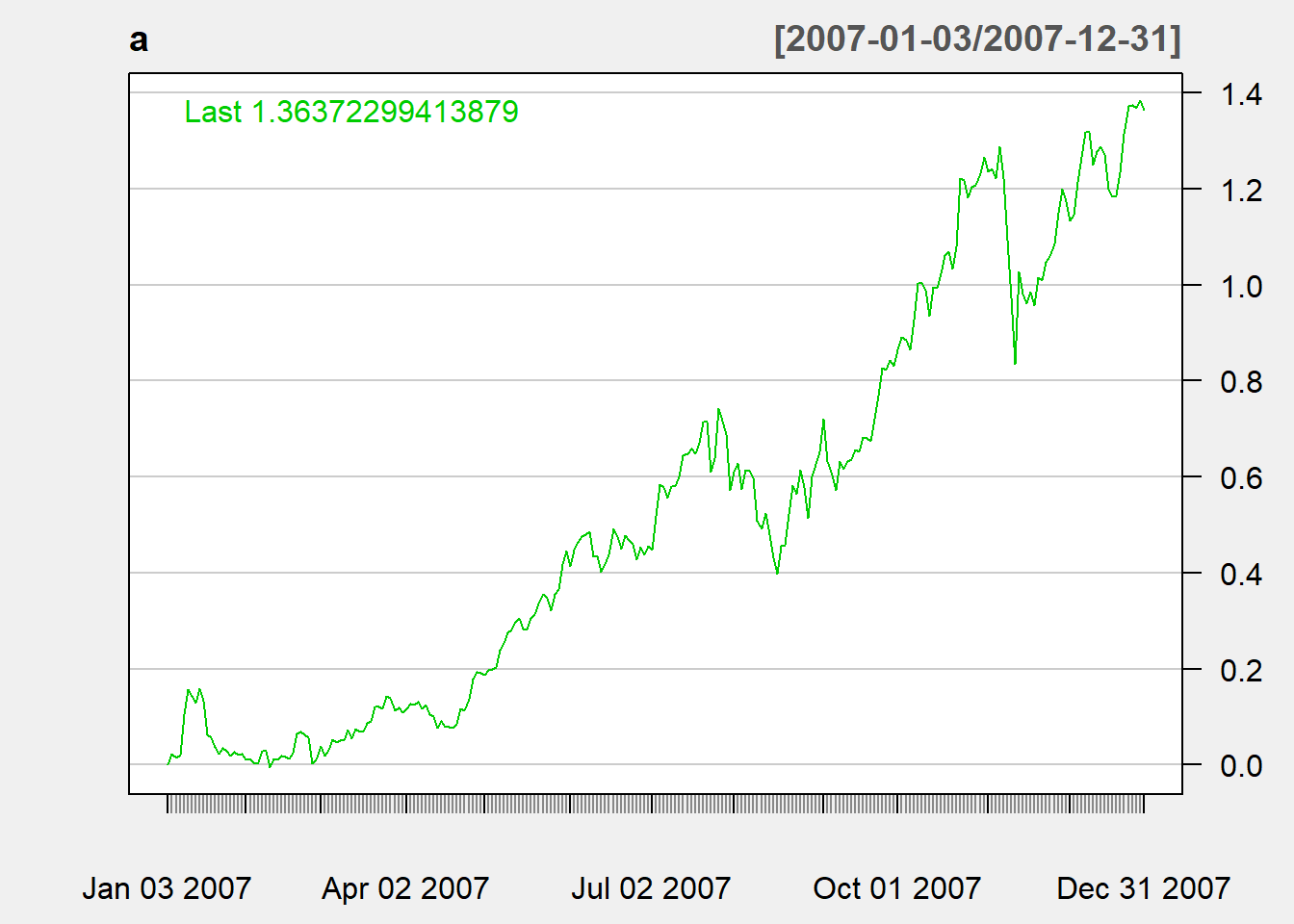

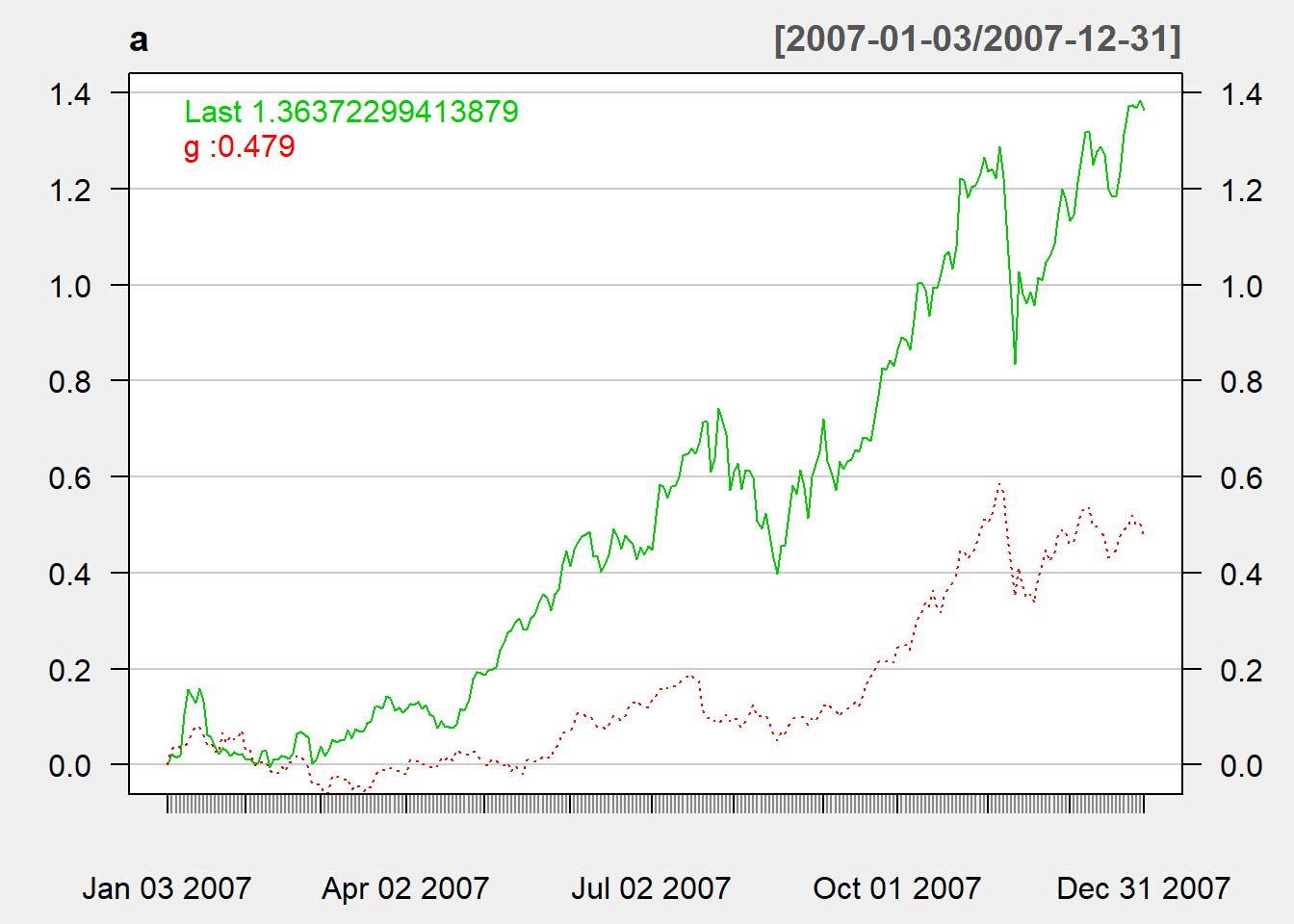

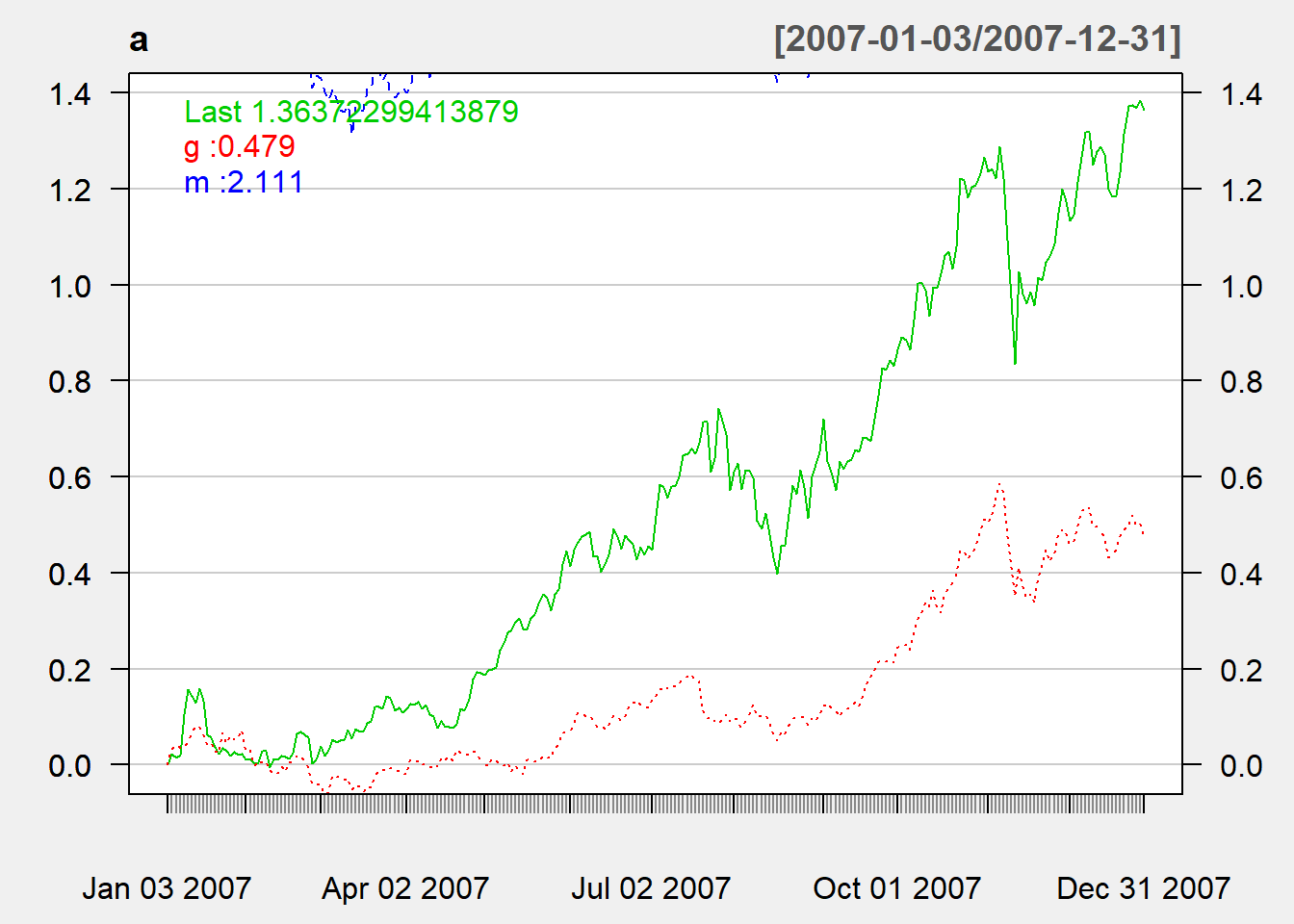

Charting Price changes of two stocks

To compare prices fo different stocks, we need to calculat the price change:

NS <- function(xdat) xdat / coredata(xdat)[1]

a <- NS(Cl(AAPL))-1

g <- NS(Cl(GOOG))-1

m <- NS(Cl(MSFT))-1

chartSeries(a,

subset = '2007',

theme=chartTheme('white'))

addTA(g, on=1, col="red", lty="dotted")

addTA(m, on=1, col="blue", lty="dashed")

The option lty is to make the line becomes other line styles where dotted means dotted line and dashed means dashed line.

Performance Evaluation

The package is a collection of econometric functions for performance and risk analysis.

We first install and load PerformanceAnalytics package.

install.packages("PerformanceAnalytics")

library(PerformanceAnalytics)Evaluating Trading Rules

To simplify, we first evaluate several trading rules based on day trading:

- buy signal based on simple filter rule

- buy and sell signals based on simple filter rule

- buy signal based on RSI

- buy signal based on EMA and sell signal based on RSI

- buy signal based on RSI but trading size depends on price history

Finally, we consider the rule that does non-day trading. In this case, we need to keep track of both cash and stock holdings.

Simple filter Buy

Here we create trading signal based on simple filter rule. Recall that simple filter rule suggests buying when the price increases a lot compared to the yesterday price: \[\begin{align*} \text{Buy}&:\frac{P_t}{P_{t-1}}>1+\delta \\ \end{align*}\]where \(P_t\) is the closing price at time \(t\) and \(\delta>0\) is an arbitrary threshold

We illustrate using Microsoft with ticker MSFT.

We first download the data using getSymbols(“MSFT”).

library(quantmod)

getSymbols("MSFT")## [1] "MSFT"We first will use closing price to perform calculation. We calculate the percentage price change by dividing the current close price by its own lag and then minus 1.

Now we generate buying signal based on filter rule:

price <- Cl(MSFT) # close price

r <- price/Lag(price) - 1 # % price change

delta <-0.005 #threshold

signal <-c(0) # first date has no signal

#Loop over all trading days (except the first)

for (i in 2: length(price)){

if (r[i] > delta){

signal[i]<- 1

} else

signal[i]<- 0

}Note that signal is just a vector without time stamp. We use the function reclass to convert it into an xts object.

# Each data is not attached with time

head(signal, n=3)## [1] 0 0 0# Assign time to action variable using reclass;

signal<-reclass(signal,price)

# Each point is now attached with time

tail(signal, n=3)## [,1]

## 2019-07-29 0

## 2019-07-30 0

## 2019-07-31 0We are now ready to chart the trading indicators:

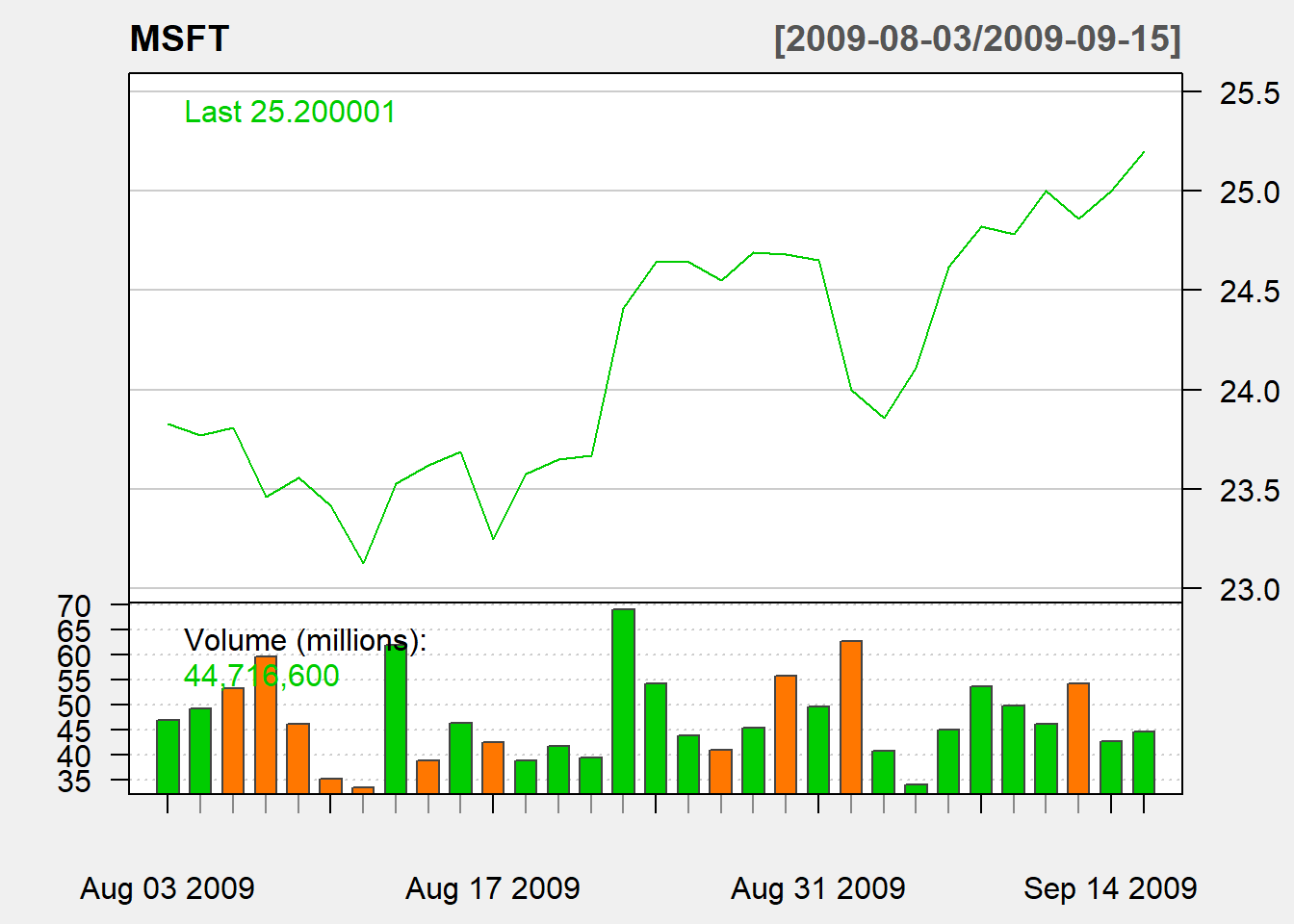

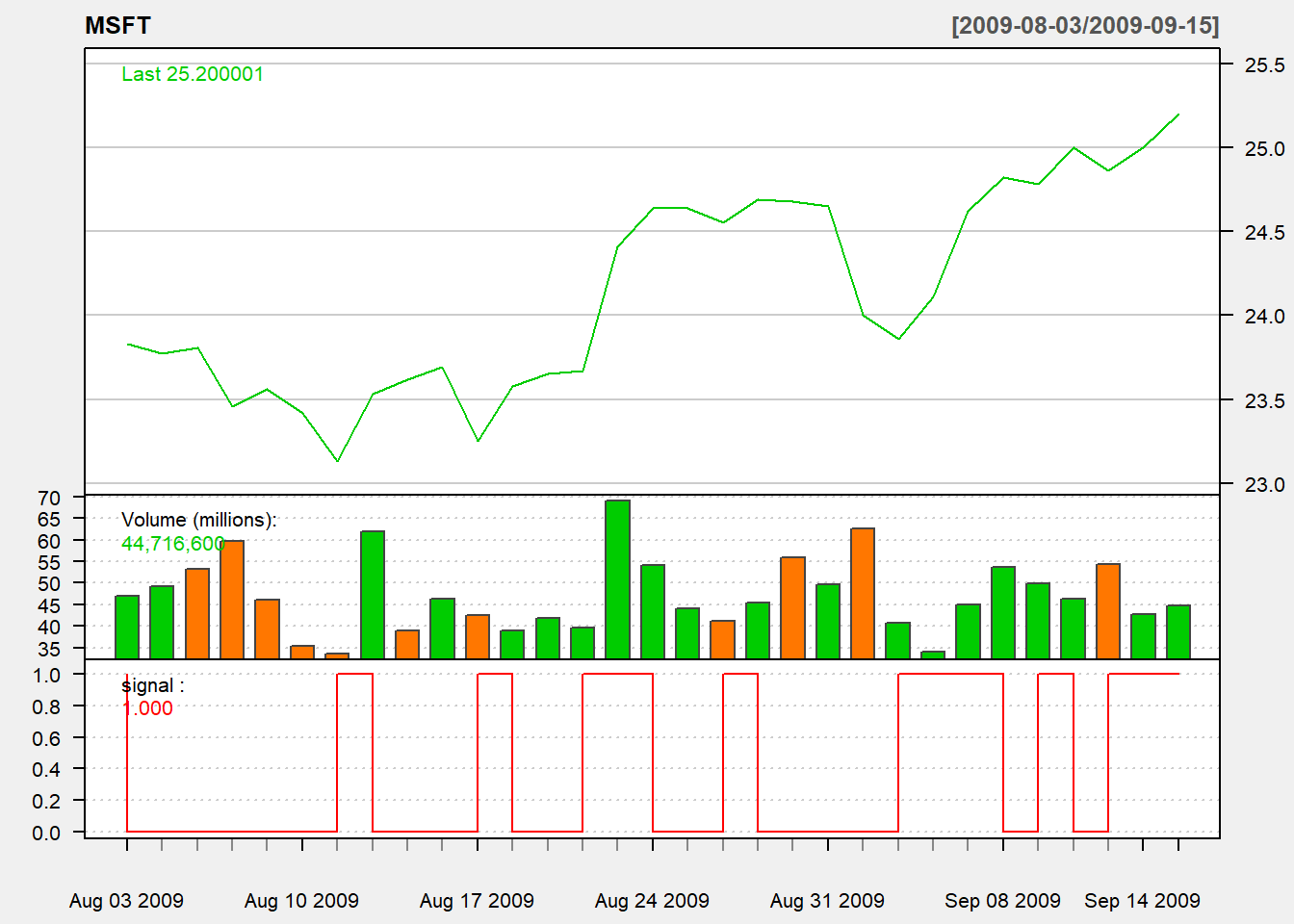

# Charting with Trading rule

chartSeries(MSFT,

type = 'line',

subset="2009-08::2009-09-15",

theme=chartTheme('white'))

addTA(signal,type='S',col='red')

We consider trading based on yesterday indicator:

trade <- Lag(signal,1) # trade based on yesterday signalTo keep it simple, we evaluate using day trading:

- buy at open

- sell at close

- trading size: all in

Then daily profit rate is \(dailyReturn=\frac{Close - Open}{open}\)

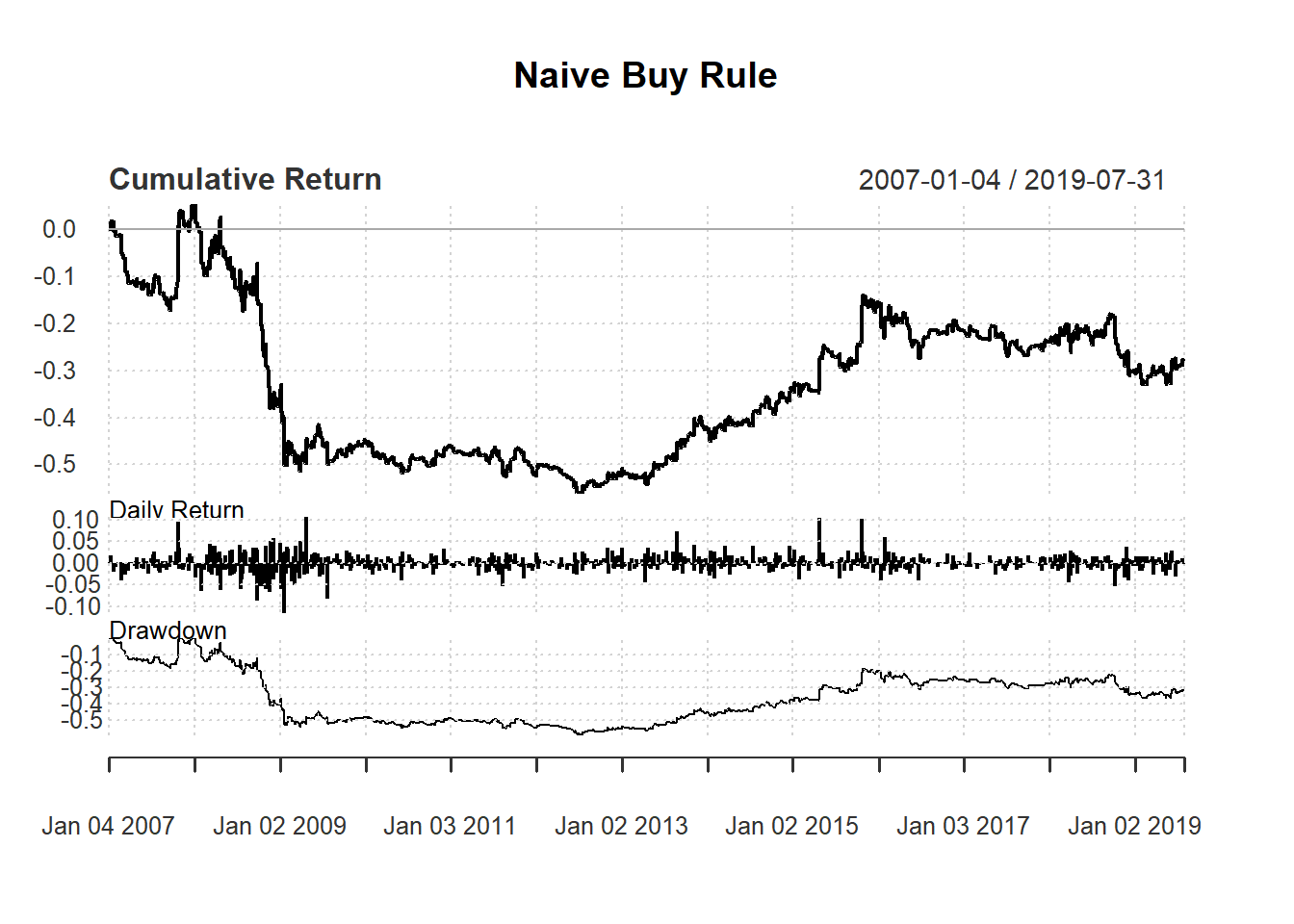

ret<-dailyReturn(MSFT)*trade

names(ret)<-"filter"Based on daily return, we can see the summary of performance using charts.PerformanceSummary() to evaluate the performance.

#Performance Summary

charts.PerformanceSummary(ret, main="Naive Buy Rule")

Simple fiter buy-sell

Here we create trading signal based on simple filter rule. Recall that simple filter rule suggests buying when the price increases a lot compared to the yesterday price and selling when price decreases a lot: \[\begin{align*} \text{Buy}&:\frac{P_t}{P_{t-1}}>1+\delta \\ \text{Sell}&:\frac{P_t}{P_{t-1}}<1-\delta \end{align*}\]where \(P_t\) is the closing price at time \(t\) and \(\delta>0\) is an arbitrary threshold

We first download the data:

library(quantmod)

getSymbols("MSFT")## [1] "MSFT"price <- Cl(MSFT)

r <- price/Lag(price) - 1

delta<-0.005

signal <-c(NA) # first signal is NA

for (i in 2: length(Cl(MSFT))){

if (r[i] > delta){

signal[i]<- 1

} else if (r[i]< -delta){

signal[i]<- -1

} else

signal[i]<- 0

}

signal<-reclass(signal,Cl(MSFT))

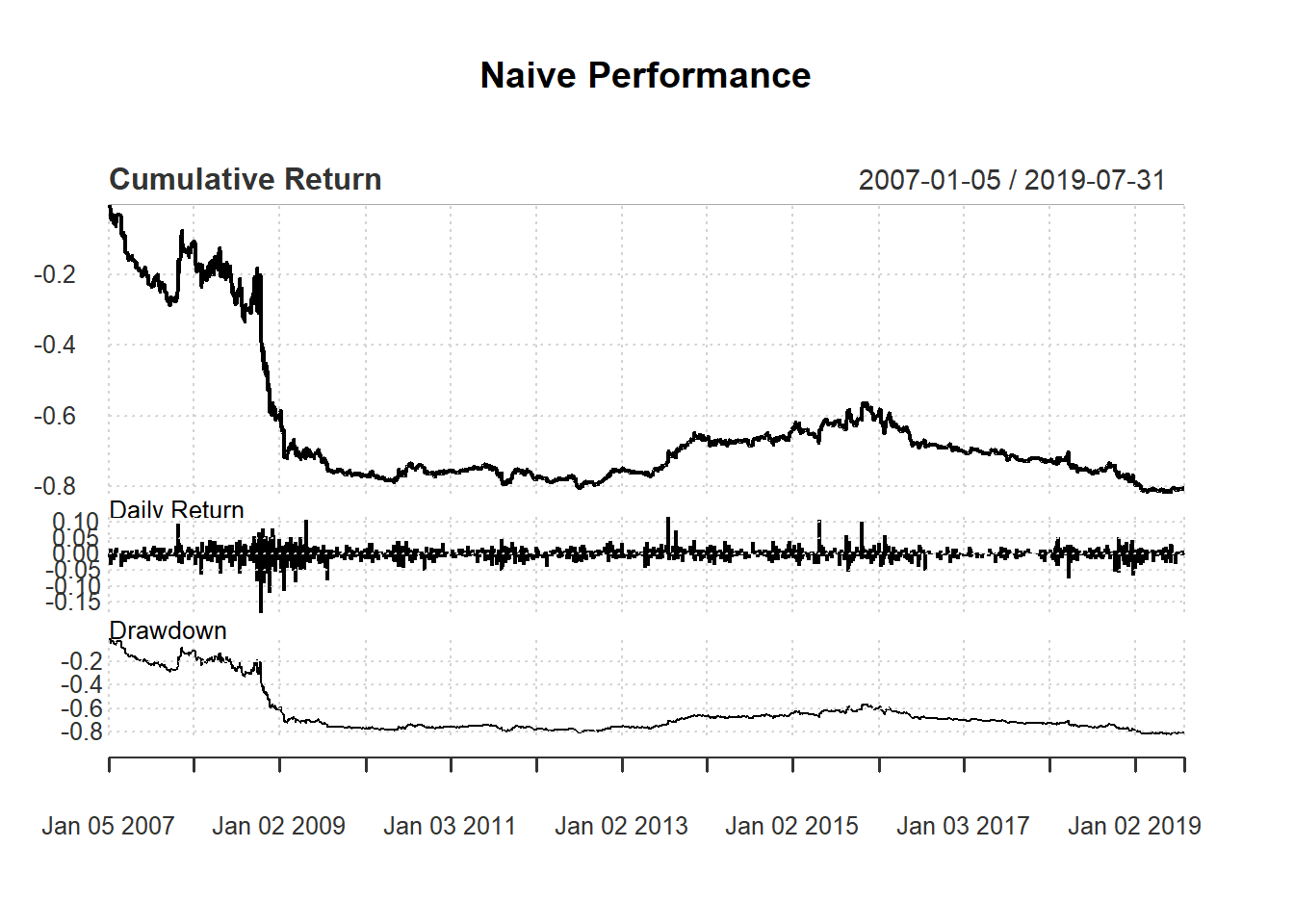

trade1 <- Lag(signal)

ret1<-dailyReturn(MSFT)*trade1

names(ret1) <- 'Naive'

charts.PerformanceSummary(ret1)

Exercise

Test the following strategy based on EMA: - Buy/Sell signal based on EMA rule. - Day trading based on yesterday signal: - buy at open and - sell at close on the same day

An example using RSI

Consider following day-trading strategy based on 14-day RSI:

- buy one unit if RSI <30 and

- otherwise no trade.

Evaluate this based on day trading and compare it with simple filter rule:

day <-14

price <- Cl(MSFT)

signal <- c() #initialize vector

rsi <- RSI(price, day) #rsi is the lag of RSI

signal [1:day+1] <- 0 #0 because no signal until day+1

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy if rsi < 30

signal[i] <- 1

}else { #no trade all if rsi > 30

signal[i] <- 0

}

}

signal<-reclass(signal,Cl(MSFT))

trade2 <- Lag(signal)

#construct a new variable ret1

ret1 <- dailyReturn(MSFT)*trade1

names(ret1) <- 'Naive'

# construct a new variable ret2

ret2 <- dailyReturn(MSFT)*trade2

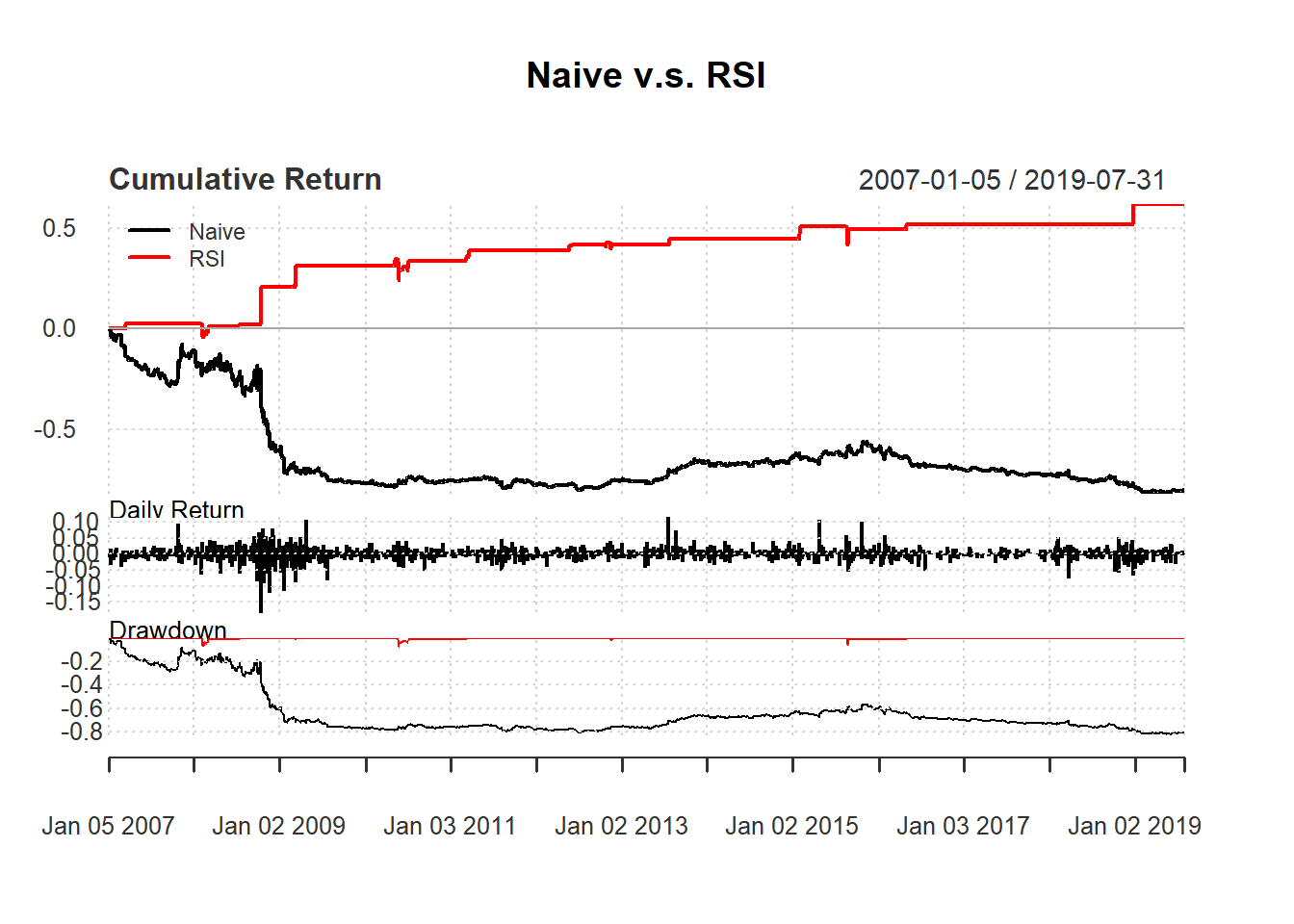

names(ret2) <- 'RSI'Now compare strategies with the filter rule:

retall <- cbind(ret1, ret2)

charts.PerformanceSummary(retall,

main="Naive v.s. RSI")

More efficient code

In the RSI code above, we have written that:

signal [1:day+1] <- 0

for (i in (day+1): length(price)){

if (rsi[i] < 30){

signal[i] <- 1

}else {

signal[i] <- 0

}

}A more efficient but less readable code is to avoid counting:

for (i in 1:length(price)){

signal[i] <- 0

if (isTRUE(rsi[i] < 30)){

signal[i] <- 1

}

}Combining two indicators: filter and RSI

Test the following strategy using filter and RSI based on day trading:

Buy signal based on filter rule.

Sell signal based on RSI rule.

Tie-breaking: buy-signal has priority

We use 14-day RSI and use 70 as threshold for selling.

n <- 14

delta<-0.005

price <- Cl(MSFT)

r <- price/Lag(price) - 1

rsi <- RSI(price, n)

signal <-c() # first signal is NA

signal[1:n] <-0

# Generate Trading Signal

for (i in (n+1):length(price)){

if (r[i] > delta){

signal[i]<- 1

} else if (rsi[i] > 70){

signal[i]<- -1

} else

signal[i]<- 0

}

signal<-reclass(signal,price)

## Apply Trading Rule

trade3 <- Lag(signal)

ret3<-dailyReturn(MSFT)*trade3

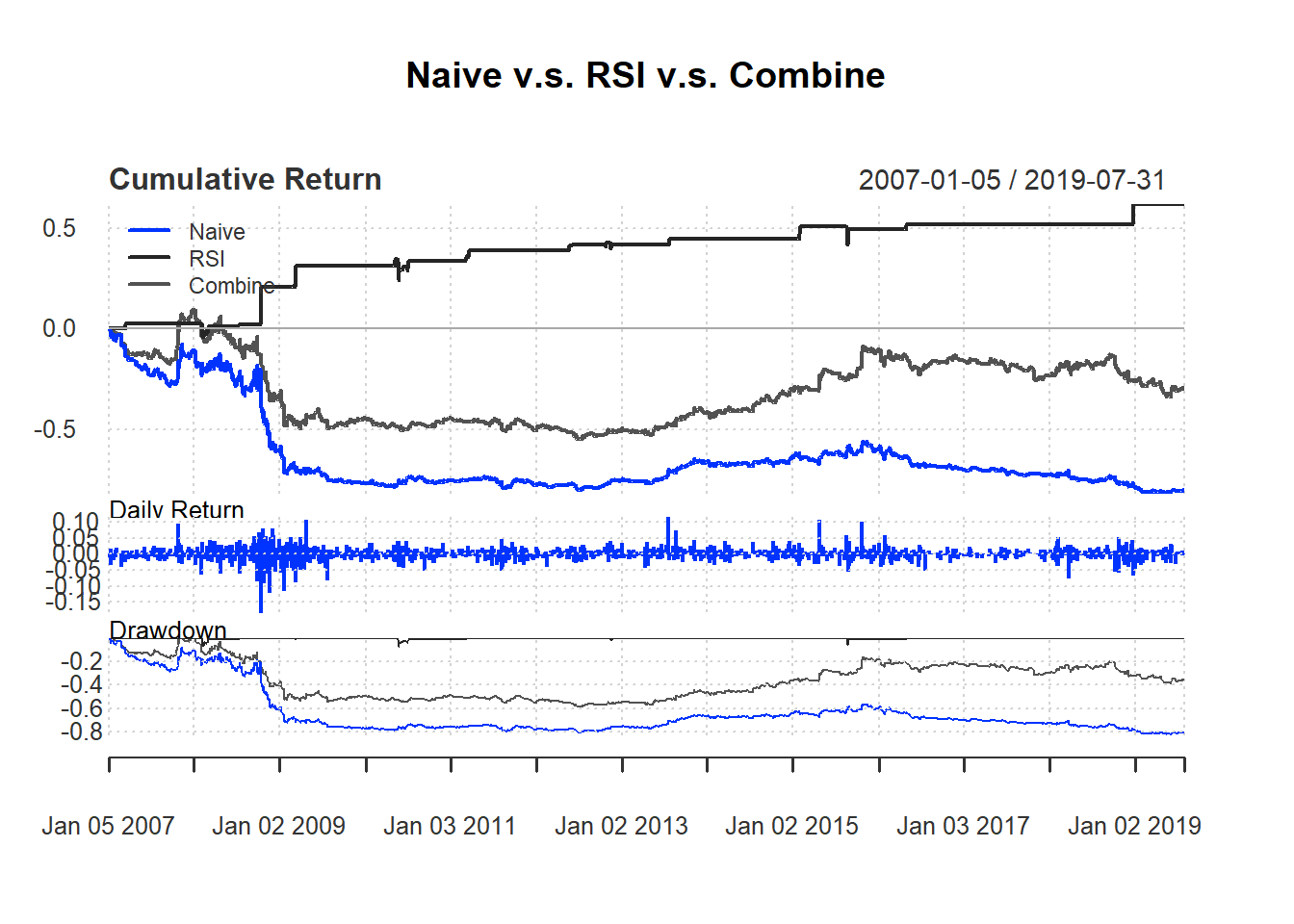

names(ret3) <- 'Combine'

retall <- cbind(ret1, ret2, ret3)To draw trade performance summary with different colors, we use the option colorset. Common options includes redfocus, bluefocus, greenfocus, rainbow4equal andrich12equal.

charts.PerformanceSummary(

retall, main="Naive v.s. RSI v.s. Combine",

colorset=bluefocus)

Exercise

Test the following strategy based on EMA and RSI

Buy signal based on EMA rule.

Sell signal based on RSI rule

Day trading based on yesterday signal: buy at open and sell at close

Trading Size

Wealth: 1 million

Trade unit: 1000 stocks per trade

Test the following strategy based on 14-day RSI :

Buy one more unit if RSI <30.

Keep buying the same if 30 < RSI < 50

Stop trading if RSI >= 50

Evaluate based on day trading

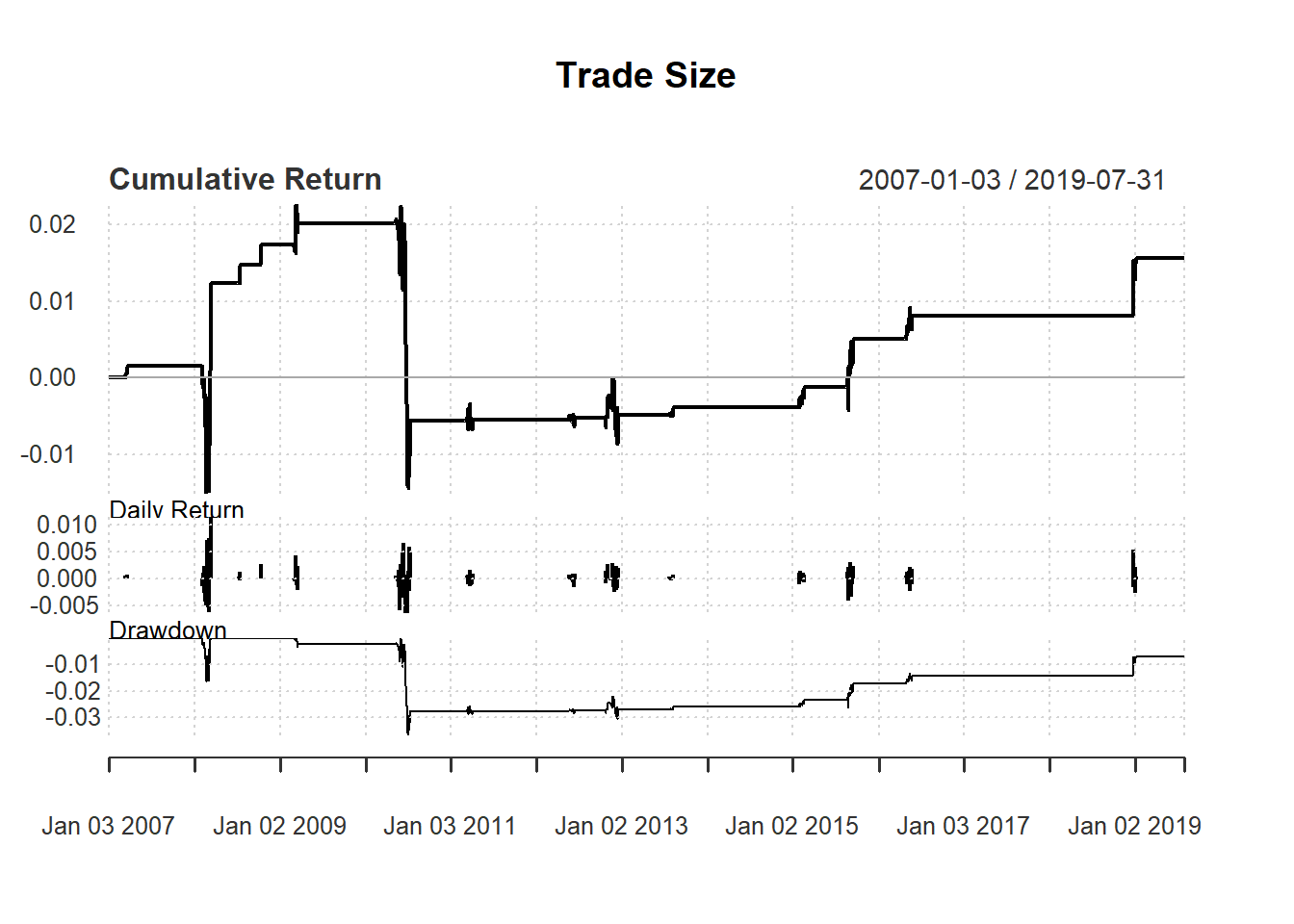

To take trade size into account, we need to keep track of wealth:

qty <-1000

day <-14

signal <- c() #trade signal with size

signal[1:(day+1)] <- 0

price <- Cl(MSFT)

wealth <-c()

wealth[1:(day+1)] <- 1000000

return<-c()

return[1:(day+1)] <- 0

profit <-c()

profit[1:(day+1)] <- 0We now generate trading signal with size:

rsi <- RSI(price, day) #rsi is the lag of RSI

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy one more unit if rsi < 30

signal[i] <- signal[i-1]+1

} else if (rsi[i] < 50){ #no change if rsi < 50

signal[i] <- signal[i-1]

} else { #sell if rsi > 50

signal[i] <- 0

}

}

signal<-reclass(signal,price)Now we are ready to apply Trade Rule

Close <- Cl(MSFT)

Open <- Op(MSFT)

trade <- Lag(signal)

for (i in (day+1):length(price)){

profit[i] <- qty * trade[i] * (Close[i] - Open[i])

wealth[i] <- wealth[i-1] + profit[i]

return[i] <- (wealth[i] / wealth[i-1]) -1

}

ret3<-reclass(return,price)

charts.PerformanceSummary(ret3, main="Trade Size")

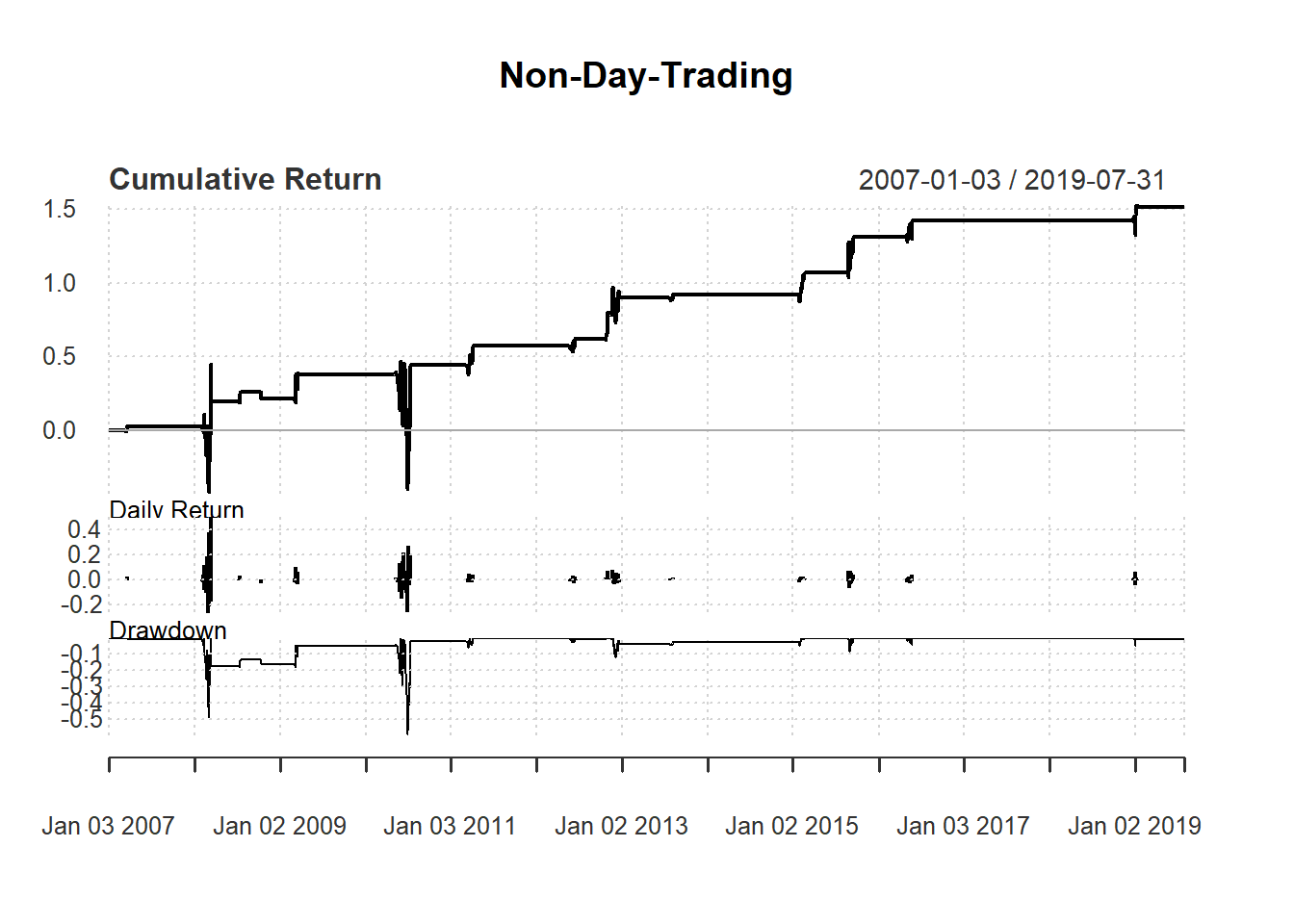

Non-Day Trading

Trading signal:

Buy signal arises if 14-day RSI < 30

Sell signal arises if 14-day RSI > 50

Trading Rule

Buy 300 units under buy signal

Sell all when sell signal appears

Initial wealth: 10,000

Note that we need to keep track of both cash and stock holdings.

qty <-300

day <-14

signal <- c() #trade signal

signal[1:(day+1)] <- 0

price <- Cl(MSFT)

stock <- c() #stock holding

stock[1:(day+1)] <-0

cash <-c()

cash[1:(day+1)] <- 10000 Trading signal is based on simple RSI:

rsi <- RSI(price, day) #rsi is the lag of RSI

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy one more unit if rsi < 30

signal[i] <- 1

} else if (rsi[i] < 50){ #no change if rsi < 50

signal[i] <- 0

} else { #sell if rsi > 50

signal[i] <- -1

}

}

signal<-reclass(signal,price)Assume buying at closing price. We keep track of how cash and stock changes:

trade <- Lag(signal) #rsi is the lag of RSI

for (i in (day+1): length(price)){

if (trade[i]>=0){

stock[i] <- stock[i-1] + qty*trade[i]

cash[i] <- cash[i-1] -

qty*trade[i]*price[i]

} else{

stock[i] <- 0

cash[i] <- cash[i-1] +

stock[i-1]*price[i]

}

}

stock<-reclass(stock,price)

cash<-reclass(cash,price)To evaluate performance, we calculate equity using cash and stock holdings.

equity <-c()

equity[1:(day+1)] <- 10000

return<-c()

return[1:(day+1)] <- 0

for (i in (day+1): length(price)){

equity[i] <- stock[i] * price[i] + cash[i]

return[i] <- equity[i]/equity[i-1]-1

}

equity<-reclass(equity,price)

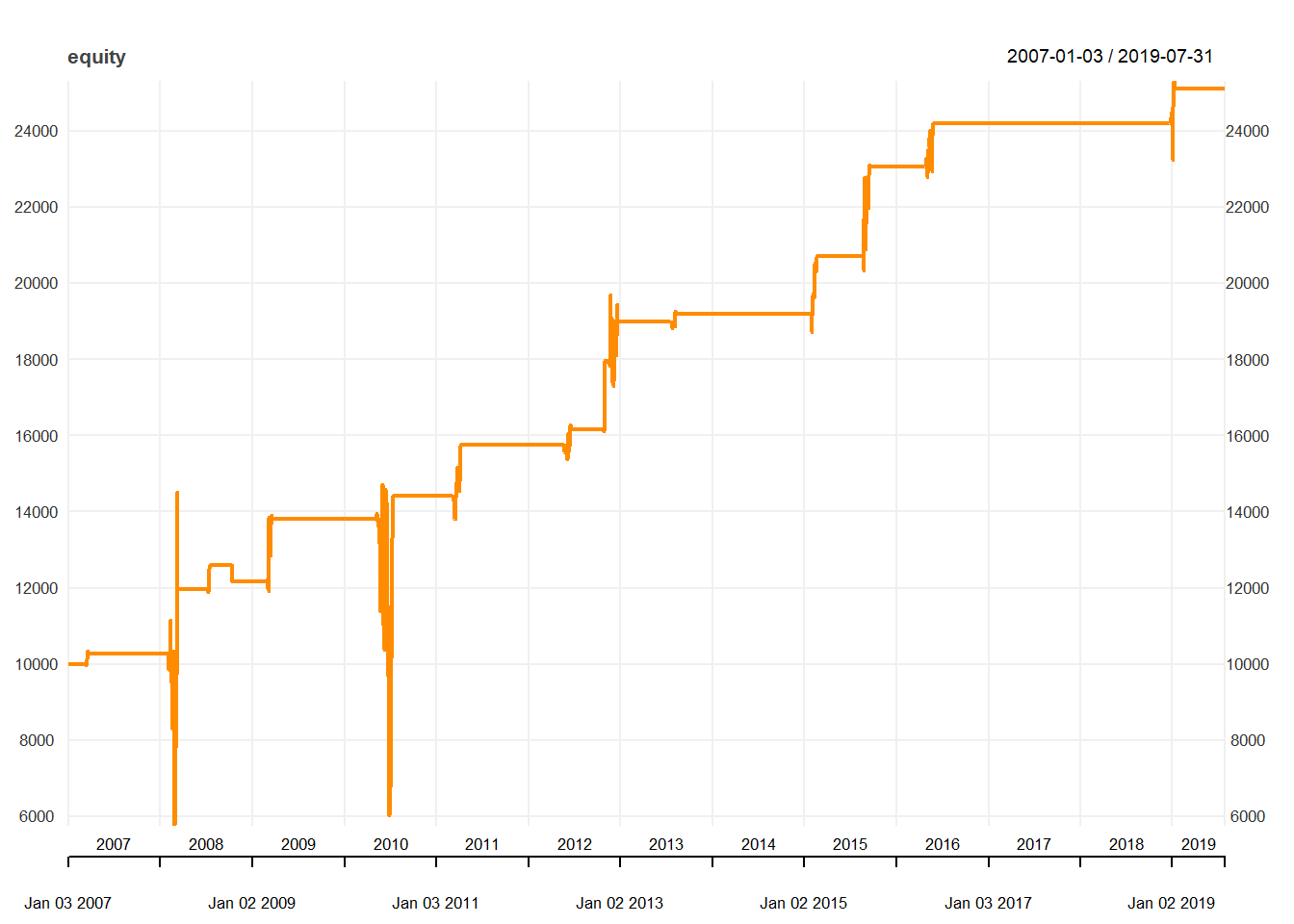

return<-reclass(return,price)Performance Charts

charts.PerformanceSummary(return,

main="Non-Day-Trading")

We can plot the equity line showing how the performance of the strategy:

chart_Series(equity, main="equity line")

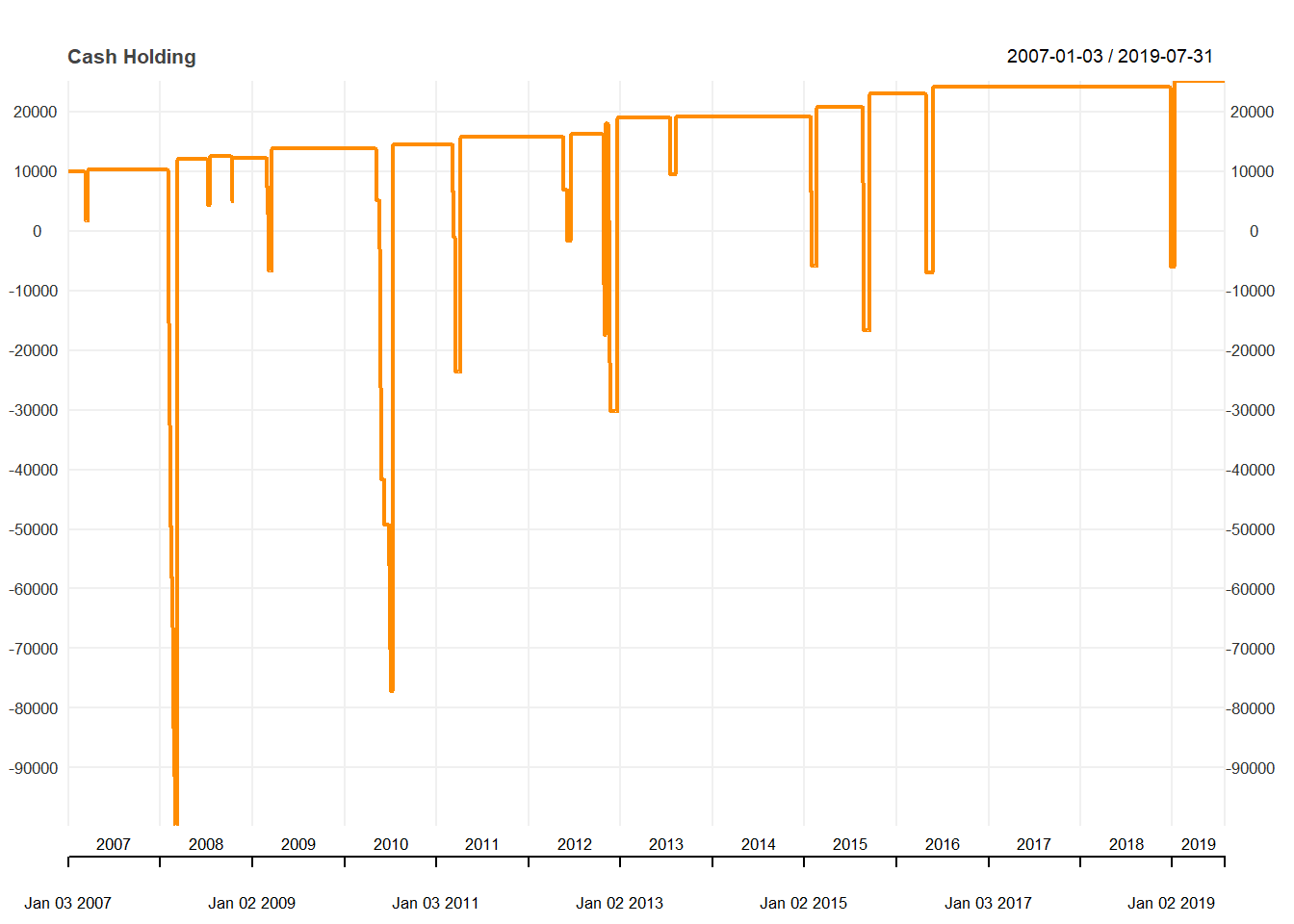

We can check the cash account over time:

chart_Series(cash, name="Cash Holding")

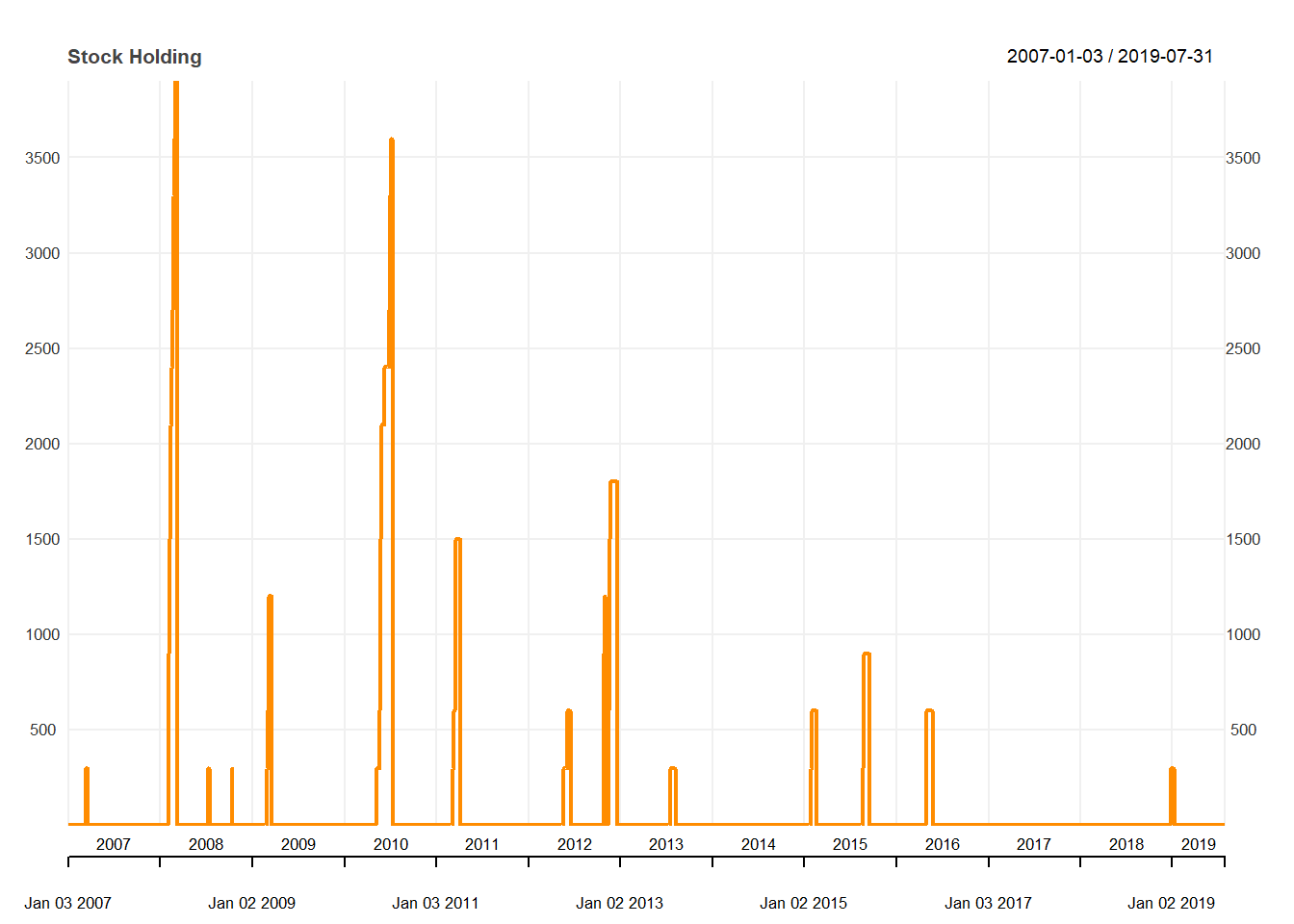

Finall, We can stock holdings:

chart_Series(stock, name="Stock Holding")

Exercise

Trading signal:

Buy signal arises if RSI < 30

Sell signal arises if RSI >50

Trading Rule

Buy 1000 units under buy signal

Sell 1000 units under sell signal